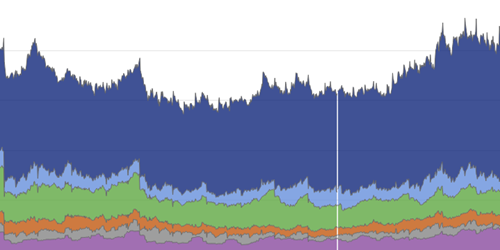

Centrally Cleared Repo Outstanding Volume By Venue And Tenor

Tenor

The tenor of a financial contract refers to the amount of time before that contract expires. Tenor aggregates can be used to examine the provision of funding over different time horizons. These charts present insights into the tenor of financing across various short-term funding markets.

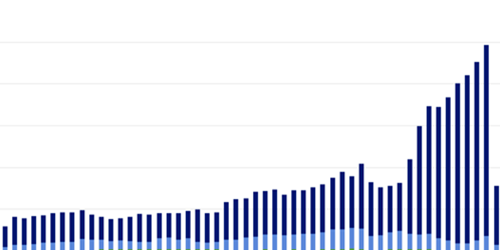

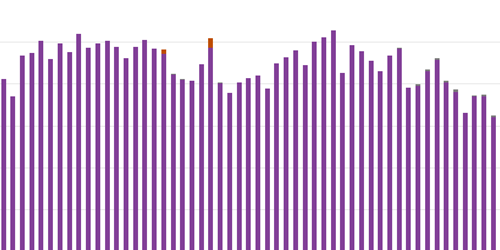

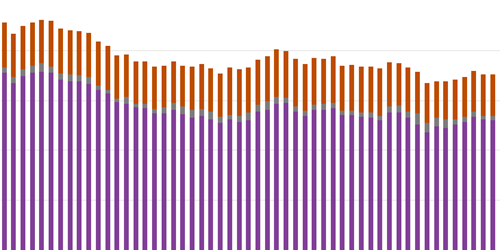

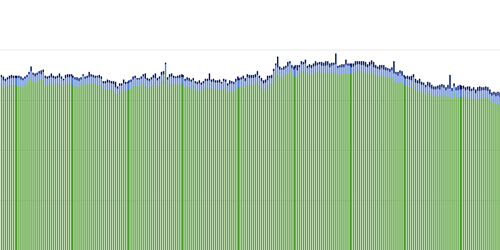

Centrally cleared repo outstanding volume by venue and tenor

Transaction volume in the Fixed Income Clearing Corporation's (FICC) GCF Repo Service and DVP Service broken out by tenor Mnemonics

Skip the ChartOne of the ways the market for repurchase agreements (repo) supports cash market liquidity is by allowing financial institutions to fund their portfolios using securities as collateral. The STFM currently presents data on two centrally cleared repo platforms, FICC's GCF Repo Service and DVP Service. Participants in these services use them to fund their security portfolios over different time horizons. Participants also use the DVP Service to obtain specific securities, supporting both cash market liquidity and price discovery.

This chart shows a breakdown of GCF Repo Service and DVP Service volumes by the repo's tenor, which is the amount of time between the initial trade of cash for securities and the repurchase of those securities. Financing needs can vary by time horizon, leading to demand for loans of a different tenor. Shorter-tenor trades maximize lenders' liquidity, typically reducing rates borrowers have to pay. However, borrowers in shorter-tenor trades carry

the risk that financing rates increase or that financing becomes unavailable, which is referred to as rollover risk. In addition, longer-tenor trades are treated differently for regulatory purposes than shorter-tenor trades. Examining volume across tenors in these markets provides a window into the availability of and demand for financing across time horizons. In periods of high volatility, longer-tenor trades can provide more stability to borrowers, but during these times it may also be difficult for lenders to extend credit at longer horizons.

Series Used

This OFR monitor is presented solely for informative purposes and should not be relied upon for financial decisions; it is not intended to provide any investment or financial advice. If you have any specific questions about any financial or other matter please consult an appropriately qualified professional. The OFR makes no warranty, express or implied, nor assumes any legal liability or responsibility for the accuracy, completeness, reliability, and usefulness of any information that is available through this website, nor represents that its use would not infringe on any privately owned rights.

Disclaimer Regarding Non-OFR Data and InformationFor convenience and informational purposes only, the OFR may provide links and references to nongovernment sites. These sites may contain information that is copyrighted with restrictions on reuse. Permission to use copyrighted materials must be obtained from the original source and cannot be obtained from the OFR or from the U.S. Treasury Department. The OFR is not responsible for the content of external websites linked to or referenced from this site or from the OFR web server. The U.S. government, the U.S. Treasury Department, the Financial Stability Oversight Council, and the OFR neither endorse the data, information, content, materials, opinions, advice, statements, offers, products, services, presentation, or accuracy, nor make any warranty, express or implied, regarding these external websites. Please note that neither the U.S. Treasury Department nor the OFR controls, and cannot guarantee, the relevance, timeliness, or accuracy of third-party content or other materials. Users should be aware that when they select a link on this OFR website to an external website, they are leaving the OFR site.

Suggested CitationOffice of Financial Research, “OFR Short-term Funding Monitor,” refreshed daily, https://www.financialresearch.gov/short-term-funding-monitor/ (accessed ).