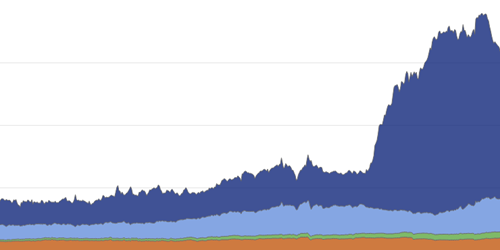

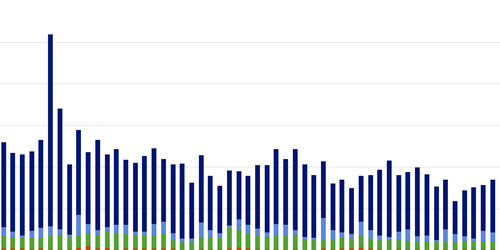

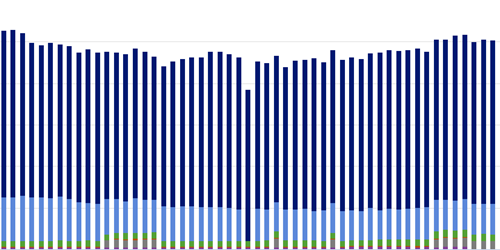

Tri-Party Repo Transaction Volume By Collateral Type

Collateral

Short-term funding markets often require that borrowers pledge securities as collateral against the possibility they may default on a loan. Types of collateral vary and can influence the rate of return charged for short-term funding and the willingness of lenders to extend such funding. The types of securities that appear as collateral can also indicate the security positions for which borrowers need financing. These charts present insights into the types of collateral used to secure funding across various short-term funding markets.

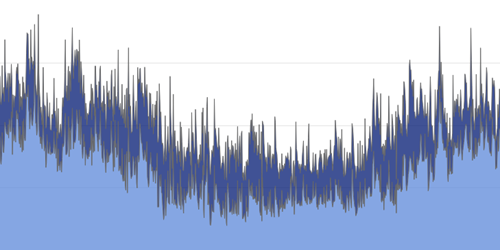

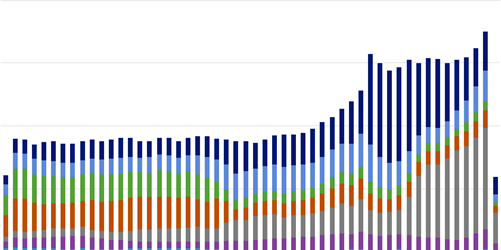

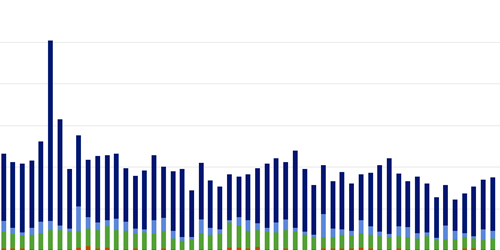

Tri-party repo transaction volume by collateral type

Transaction volume in tri-party repo market broken out by type of collateral

Skip the ChartIn tri-party repurchase (repo) transactions, participants know their counterparty, but transact against classes of collateral, rather than specific securities. As a result, tri-party repo is used only for financing, and not for obtaining specific securities. A custodian, usually a bank, maintains post-trade processing activities such as collateral selection, payments and deliveries, custody of collateral securities, and collateral management. Borrowers in tri-party repo tend to be larger dealers to which cash lenders are willing to be directly exposed.

This chart shows a breakdown of tri-party repo volumes after excluding transactions with the Federal Reserve by the underlying security used as collateral. Looking at the volume of repo secured by each type of collateral provides a sense of which securities borrowers want to finance. Large movements in these volumes can indicate changes in demand for financing specific types of securities.

Series Used

This OFR monitor is presented solely for informative purposes and should not be relied upon for financial decisions; it is not intended to provide any investment or financial advice. If you have any specific questions about any financial or other matter please consult an appropriately qualified professional. The OFR makes no warranty, express or implied, nor assumes any legal liability or responsibility for the accuracy, completeness, reliability, and usefulness of any information that is available through this website, nor represents that its use would not infringe on any privately owned rights.

Disclaimer Regarding Non-OFR Data and InformationFor convenience and informational purposes only, the OFR may provide links and references to nongovernment sites. These sites may contain information that is copyrighted with restrictions on reuse. Permission to use copyrighted materials must be obtained from the original source and cannot be obtained from the OFR or from the U.S. Treasury Department. The OFR is not responsible for the content of external websites linked to or referenced from this site or from the OFR web server. The U.S. government, the U.S. Treasury Department, the Financial Stability Oversight Council, and the OFR neither endorse the data, information, content, materials, opinions, advice, statements, offers, products, services, presentation, or accuracy, nor make any warranty, express or implied, regarding these external websites. Please note that neither the U.S. Treasury Department nor the OFR controls, and cannot guarantee, the relevance, timeliness, or accuracy of third-party content or other materials. Users should be aware that when they select a link on this OFR website to an external website, they are leaving the OFR site.

Suggested CitationOffice of Financial Research, “OFR Short-term Funding Monitor,” refreshed daily, https://www.financialresearch.gov/short-term-funding-monitor/ (accessed ).