How Will Central Clearing Impact the Repo Market?

Published: January 29, 2026

Views expressed are those of the authors and do not necessarily represent official positions or policy of the Office of Financial Research or the U.S. Department of the Treasury.

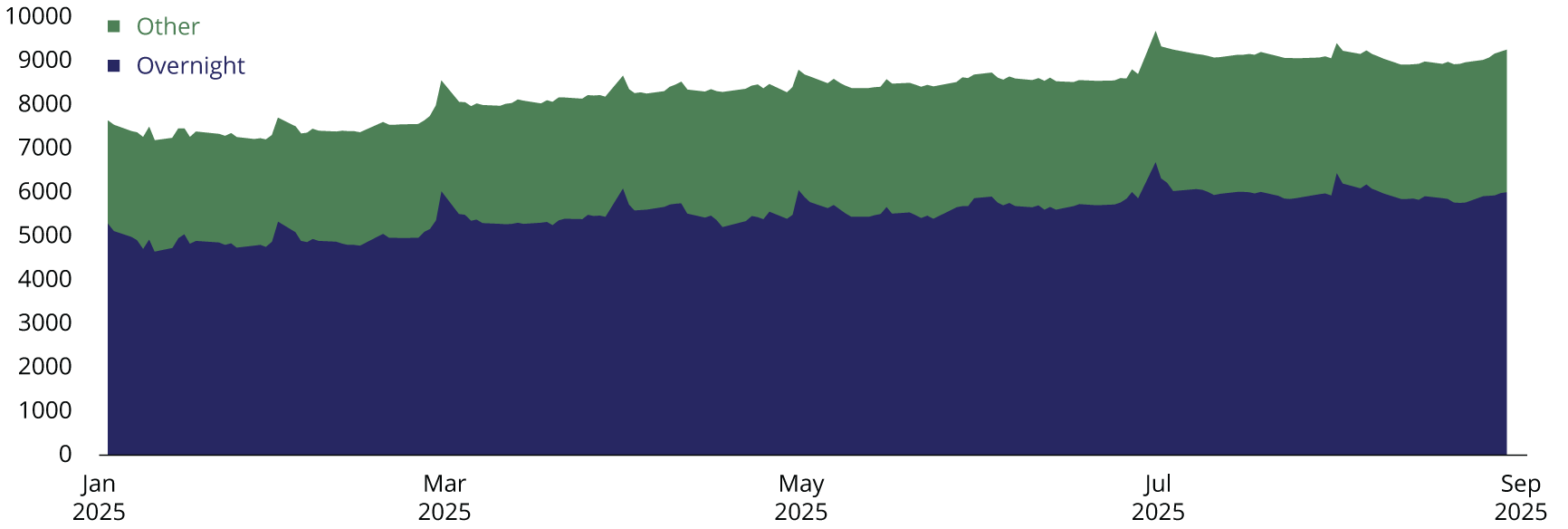

The U.S. repurchase agreement (repo) market serves as a core channel for liquidity in the U.S. Treasury market. As of August 2025, over $8 trillion in U.S. Treasury-collateralized repo was outstanding, much of which is renegotiated daily (see Figure 1). Short-term repos provide market participants with low-cost funding sources that support the smooth functioning of broader financial markets. However, these sources expose financial markets to stability risks since funding can dry up quickly.

Figure 1. Outstanding U.S. Treasury Repo ($ billions)

Note: Data are from January 1, 2025, to August 30, 2025, with federal holidays and Good Fridays removed. Overnight repos include only repos outstanding on that day with a fixed term that are set to mature in one day. Data is over all segments of the U.S. repo market.

Sources: FRBNY Tri-party repo collection, OFR cleared repo collection, OFR NCCBR collection, Authors’ analysis.

One means of addressing this vulnerability is central clearing, a process by which a central counterparty (CCP) becomes the counterparty to the transaction for both the lender and the borrower, guaranteeing the trade. Central clearing can reduce counterparty risk and provide netting efficiencies but may reduce contracting flexibility and impose costs.1 Due to the inflexibility and expenses, central clearing has had historically limited participation.

Estimating the Central Clearing Rule’s Impact on Repo Outstanding

The potential role of central clearing in enhancing Treasury market resilience has gained greater attention in recent years. The SEC adopted a rule change in 2023 requiring certain U.S. Treasury-collateralized repo to be centrally cleared by 2027.2 While this will result in more central clearing, the scale of this increase has remained uncertain.3 With the OFR’s new collection of repo data in 2024, a comprehensive and detailed assessment of which repos are mandated to be centrally cleared is now possible.

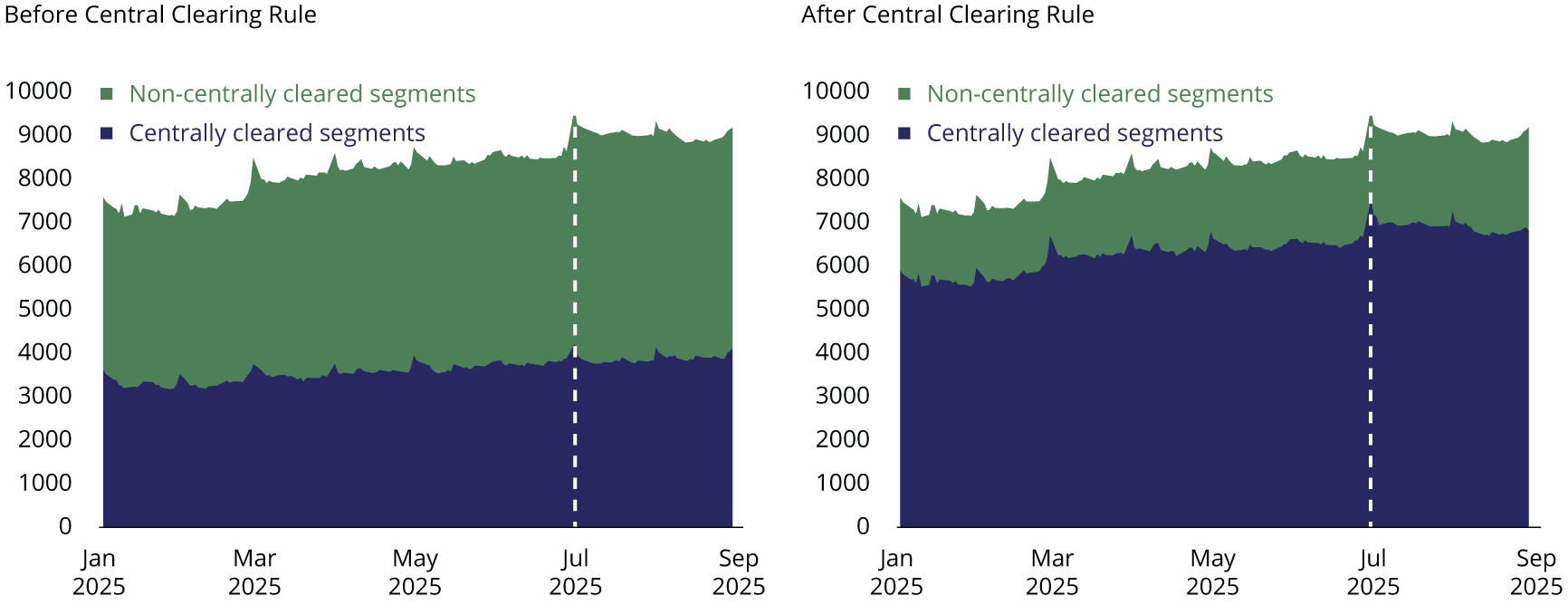

Had the central clearing rule been in place during 2025, assuming no change in the underlying repos, the bulk of Treasury repo would have been centrally cleared as the rule intends (see Figure 2). During the first eight months of 2025, 45% of average daily repo outstanding was already cleared. If the central clearing rule had been implemented, we estimate that 77% would have been cleared.

Figure 2. U.S. Treasury Repo Central Clearing ($ billions)

Note: Data are from January 1, 2025, to August 30, 2025, with federal holidays and Good Fridays removed. The dashed line represents when an additional group of reporters started providing data to the OFR, which increased the outstanding amounts. Offsetting repos are not netted in this chart.

Sources: FRBNY Tri-party repo collection, OFR cleared repo collection, OFR NCCBR collection, Authors’ analysis.

The two main types of repo that are exempt from the central clearing rule are those between affiliated entities that are legally distinct but associated with the same parent financial institution and those with embedded optionality (e.g., open and evergreen).4 Of the 23% of repo remaining non-centrally cleared, 79% would fall under the affiliated entities exemption.5 The remaining repos with embedded optionality may become eligible to clear as clearing services expand.

Estimating the Central Clearing Rule’s Impact on the SLR

The Supplementary Leverage Ratio (SLR) can be a constraining regulatory metric for repo dealers because repo activity generally puts downward pressure on the SLR.6 However, regulatory accounting rules allow dealers to net certain repo positions against offsetting reverse repo positions provided they are with the same counterparty and end on the same date.7 Since the CCP becomes the counterparty in all centrally cleared repo transactions, dealers have the ability to net more of their positions. These netting efficiencies should improve the SLRs for the bank holding companies of dealers.

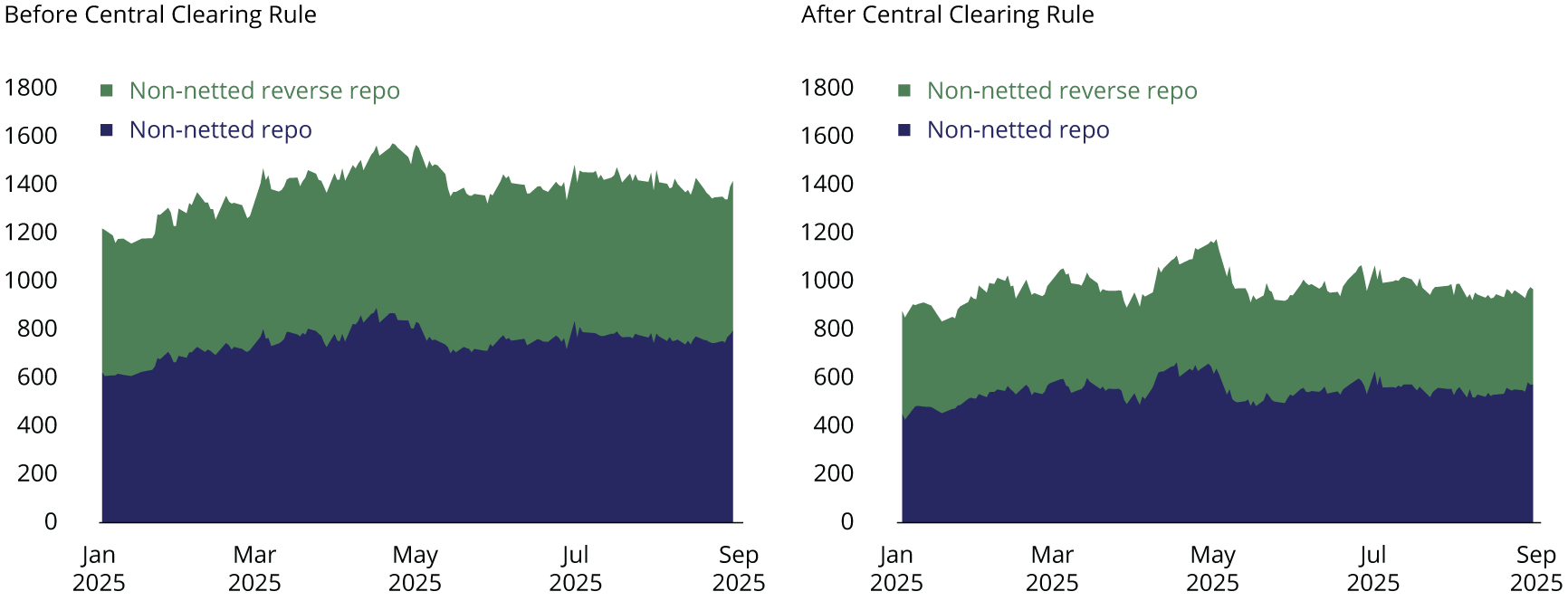

Figure 3 gives the estimated non-netted repo and reverse repo positions daily for six U.S. Global Systemically Important Banks’ (G-SIBs) that have reported data for all repo market segments, in both the current market structure and the counterfactual in which the central clearing rule had been implemented. These calculations focus only on dealer subsidiaries of U.S. G-SIBs and net all offsetting repo and reverse repo positions following regulatory accounting standards. The outstanding non-netted repo (reverse repo) positions for U.S. G-SIBs stood at $747 billion ($634 billion) at sample end. If we consider the counterfactual and assume the central clearing rule had been in effect, the non-netted repo (reverse repo) positions decline to $540 billion ($427 billion). Thus, central clearing might have netted $207 billion in additional repo as of August. This equates to roughly $34.5 billion in additional balance sheet space for each U.S. G-SIB on average.

Figure 3. U.S. G-SIB Non-Netted Repo Positions ($ billions)

Note: Data are from January 1, 2025, to August 30, 2025, with federal holidays and Good Fridays removed. For each day, each dealer’s entire portfolio of outstanding repo and reverse repo is aggregated based on counterparty and the end date. Then, for each of these groupings, the minimum of the repo and reverse repo quantities is subtracted from the maximum, and whichever quantity is positive between repo and reverse repo is kept. The figure is the sum of these quantities for each U.S. G-SIB, counterparty, and end date triplet.

Sources: FRBNY Tri-party repo collection, OFR cleared repo collection, OFR NCCBR collection, Authors’ analysis.

Daily repo data show how dealers manage their balance sheet on days surrounding regulatory reporting days like quarter-ends. Figure 3 shows no pattern in non-netted positions over the quarterly cycle. This suggests that dealers manage their balance sheet uniformly rather than altering balance sheet composition near regulatory reporting dates to manage regulatory constraints, which is consistent with previous OFR research.8

This analysis does not account for how market participants may adjust to the central clearing rule. For example, dealers might adjust contract terms to optimize netting efficiencies under central clearing. As the compliance date for the central clearing rule approaches, the OFR will continue monitoring how market participants are adjusting.

-

A repo traditionally has four main contracting terms: the rate, haircut, quantity, and tenor. The non-centrally cleared segment tends to offer more flexibility when setting these terms, which is a driver of its historically high usage. For more details on this flexibility, see Samuel J. Hempel et al., “Why Is So Much Repo Not Centrally Cleared?,” OFR Brief No. 23-01 (Office of Financial Research, May 12, 2023). ↩

-

The 2023 rule had an original compliance date of June 30, 2026. However, the compliance date was extended to June 30, 2027 in 2025. See SEC Adopts Rules to Improve Risk Management in Clearance and Settlement and Facilitate Additional Central Clearing for the U.S. Treasury Market and SEC Extends Compliance Dates and Provides Temporary Exemption for Rule Related to Clearing of U.S. Treasury Securities. ↩

-

Bowman et al 2024 is the primary previous study that has estimated the quantity of repo that will move to central clearing. However, their data only includes US G-SIBs, while our data includes a broader set of institutions for which the clearing rule will also apply. ↩

-

Open repos do not have a fixed maturity date, can be renegotiated daily, and allow either party to terminate the agreement at any time. Evergreen repos can be fixed term or open term and can be terminated by either party with an extended notice period. ↩

-

The SEC will not require affiliate repo transactions to be centrally cleared provided that the affiliated counterparty centrally clears all other eligible Treasury repo activity. In addition, the Fixed Income Clearing Corporation (FICC), the only U.S. Treasury repo Covered Clearing Agency (CCA), does not offer central clearing services for repo with optionality, rendering these types of repo exempt from the rule. While not accounted for in this analysis, the SEC will also allow certain exclusions for repos with sovereign entities, international financial institutions, natural persons, state/local governments, and other clearing organizations. See Standards for Covered Clearing Agencies for U.S. Treasury Securities and Application of the Broker-Dealer Customer Protection Rule With Respect to U.S. Treasury Securities. ↩

-

The SLR measures a bank holding company’s ratio of Tier 1 capital to its total leverage exposures. Large U.S. banks must maintain an SLR of at least 3%, while U.S. G-SIBs are held to a stricter requirement known as the “enhanced SLR”. In late 2025, U.S. regulators finalized changes to the enhanced SLR, replacing the fixed 2% buffer with a dynamic buffer. The SLR is non-risk weighted, meaning all assets are treated equally regardless of risk. For details on how leverage regulation affects the balance-sheet impact of repo, see Cimon and Garriott (2019), which models the case for a dealer intermediary. ↩

-

For more information on netting practices for repo agreements, see FASB Summary of Interpretation 41. ↩

-

Munyan 2015 argues that quarter-end netting incentives are higher for foreign-owned broker-dealers than for U.S. owned broker-dealers. These results are consistent with this view but add additional data to encompass the entire non-centrally cleared market. ↩