Key Finding on Non-centrally Cleared Repo

Published: May 12, 2023

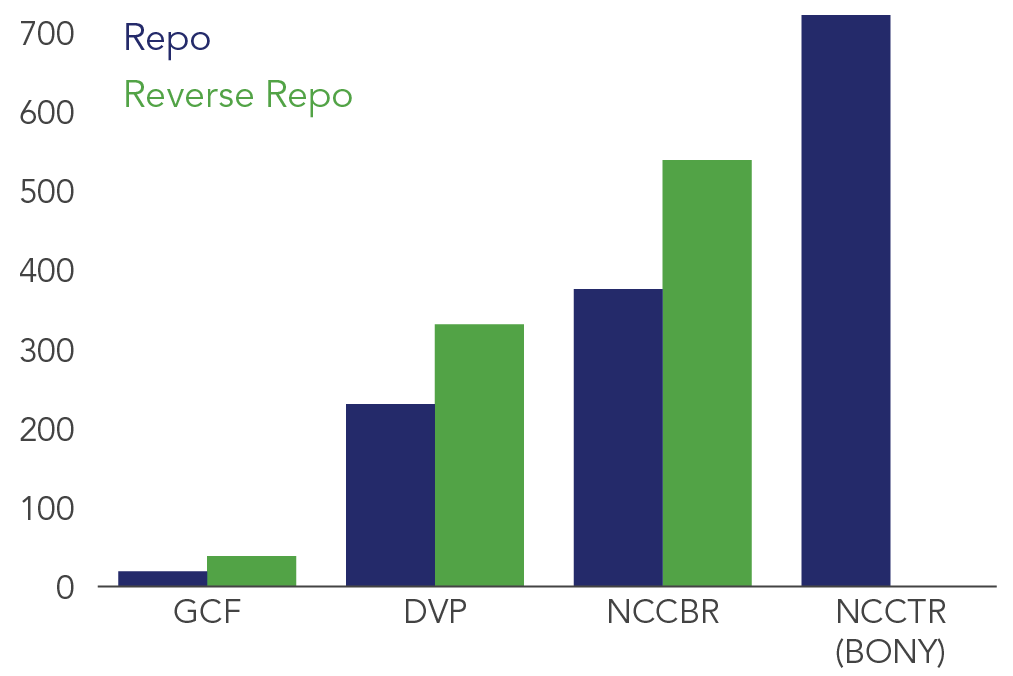

The Office of Financial Research (OFR) conducted a pilot collection of data on non-centrally cleared bilateral repurchase agreement (NCCBR) trades spanning nine dealers over three reporting dates in June 2022. Using data from this pilot collection, we document basic facts about volumes, rates, counterparty types, collateral, and haircuts in this relatively opaque segment of the repurchase (repo) market. We find that on three dimensions—rates, counterparty types, and collateral—pilot participants’ activity in the NCCBR segment roughly mirrors their activity in the centrally cleared bilateral segment, the DVP Repo Service of the Fixed Income Clearing Corporation (FICC). However, we find that haircuts in NCCBR materially differ from those in tri-party repo, with over 70% of Treasury repo in NCCBR transacted with zero haircut. Our findings suggest that differences in haircut, margining, and netting are primary factors that drive dealers’ use of NCCBR over other segments of the repo market (Brief no. 23-01).