OFR Data Analysis Shows High Growth, High Concentration in Digital Asset Market

Published: May 30, 2023

Per CSBS, reporting standards for the NMLS MSB Call Report are still under development and reporting is also still being reviewed through the supervisory process. Accordingly, CSBS has advised that the 2021 MSB Call Report data can be used on a limited basis to estimate the: (i) total volume for MSB companies in the United States; and (ii) number of companies reporting in each MSB activity. Disclaimers have been made where appropriate to identify the limits of the NMLS MSB Call Report and its focus on money transmission.

Views and opinions expressed are those of the authors and do not necessarily represent official positions or policy of the OFR or Treasury.

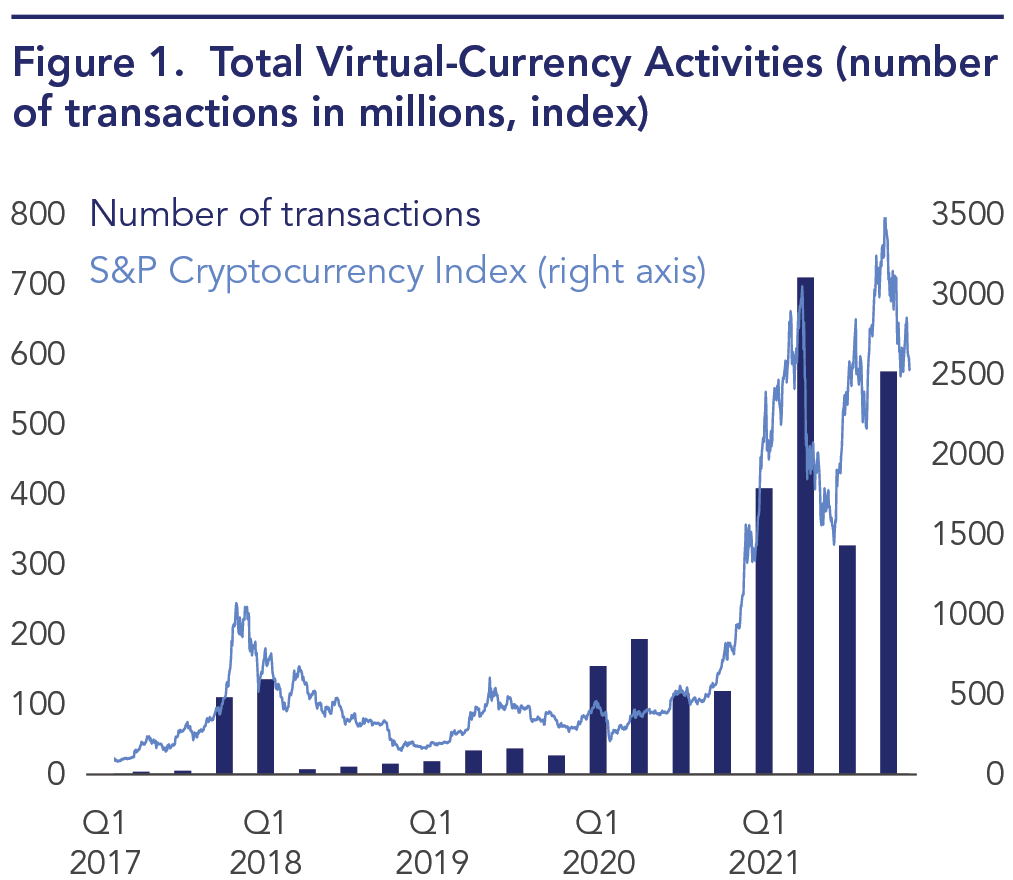

Trading in digital assets is highly concentrated and expanding rapidly, according to a recently published brief authored by Francisco E. Ilabaca and Vy Nguyen. Crypto market capitalization–the total value of the crypto market–surged to roughly $2 trillion in 2021, up from $100 billion three years ago, according to CoinMarketCap1 . Analysis of a portion of this market shows that the number of companies in this space has also been growing.

Note: The S&P Cryptocurrency LargeCap Index reflects the largest and most liquid cryptocurrencies in one index that is weighted by the equivalent of market capitalization for cryptocurrencies (coin supply × coin price). The index equals 100 at February 28, 2017.

Sources: MSB Call Report, S&P Cryptocurrency Index Series, Office of Financial Research

Employing an OFR-curated dataset, the authors find that about 80 crypto U.S. based intermediaries account for roughly 5% to 10% of global crypto trading volumes. Notably, the top quartile of these firms is responsible for 90% of transaction volumes. These firms also hold the largest amount of customers’ digital assets. The large and continued growth of digital assets, coupled with greater interconnectedness with other parts of the financial sector, could pose risks to financial stability.

The brief marks the OFR’s first analysis of key features of the digital assets market based on data reported by crypto intermediaries. All crypto intermediaries that offer trading platforms for convertible virtual currencies must register as a money services business (MSB) with Treasury’s Financial Crimes Enforcement Network. All MSBs, in turn, must report data to state regulators, and most states require that data be reported through the MSB Call Report. Using data reported by these crypto intermediaries, the authors created a dataset that represents about 5% to 10% of the digital assets market at any point in time. The authors present these stylized facts gleaned from the MSB Call Report about digital asset activities and the financial health of these intermediaries:

Note: Share of global trading volume is calculated as the total dollar amount of virtual currency transactions as a percentage of total global trading volume for each quarter.

Sources: MSB Call Report, CoinMarketCap.com, Office of Financial Research

Digital assets experienced rapid growth in recent years. Companies reported that they conducted more than 2 billion transactions totaling $1.4 trillion in virtual currency activities in 2021. By comparison, in 2020, $193 billion in activities were conducted via 586 million transactions. Just from October to December 2021, virtual currency transactions totaled $367 billion, with the mean company reporting $4.7 billion in transactions. Virtual currency held on behalf of customers also increased rapidly in 2021, jumping to $240 billion at year-end from $60 billion one year prior.

Digital asset trading exhibits a high degree of concentration among top intermediaries. A select group of companies hold the majority of digital assets and conduct nearly all digital asset transactions. At the end of 2021, more than 96% of all activities, or $356 billion of the $367 billion in transactions, were conducted by the top quartile of firms. These firms also held the majority of digital assets, with over $11 billion reported in Q4 2021, or roughly 65% of total digital assets across all companies in our sample. Of the $240 billion in virtual currency held on behalf of customers, $204 billion was held by the 5 largest firms, again illustrating the high degree of concentration.

Digital asset transactions are typically dominated by trading between digital assets. On average, virtual currency to virtual currency transactions account for about 48% of all transactions, followed by U.S. dollar to virtual currency transactions, which accounted for 32%, and virtual currency to U.S. dollar transactions, which accounted for the rest.

Digital asset platforms and other intermediaries play an important role in providing investors access to virtual currencies. They show a strong tendency toward market concentration and share common features with traditional financial intermediation. Despite being regulated primarily as MSBs, many offer services that may resemble those of broker-dealers, exchanges, custodians, and even deposit-taking institutions, raising the question of whether their activities are appropriately ring-fenced, and risks adequately managed.

The MSB Call Report offers an informative look into the activities of intermediaries in digital asset markets. While this regulatory data only captures a fraction of global crypto trading activities, it undoubtedly depicts trends reflecting the rapid growth of decentralized finance. More granular and more frequent data on the various types of crypto assets traded and held would allow regulators to better assess financial stability risks that may emerge from their activities.

Gaps in data in the crypto-asset ecosystem were also highlighted in a recent Financial Stability Oversight Council report, Report on Digital Asset Financial Stability Risks and Regulation. Among other recommendations, the Council recommended that its members consider collecting data that would facilitate assessments of financial risks related to crypto assets.

1Cryptocurrency prices, charts and market capitalizations. CoinMarketCap. (n.d.). Retrieved August 1, 2022, from https://coinmarketcap.com/.