An Early Look into Digital-Assets Regulatory Data

Published: May 30, 2023

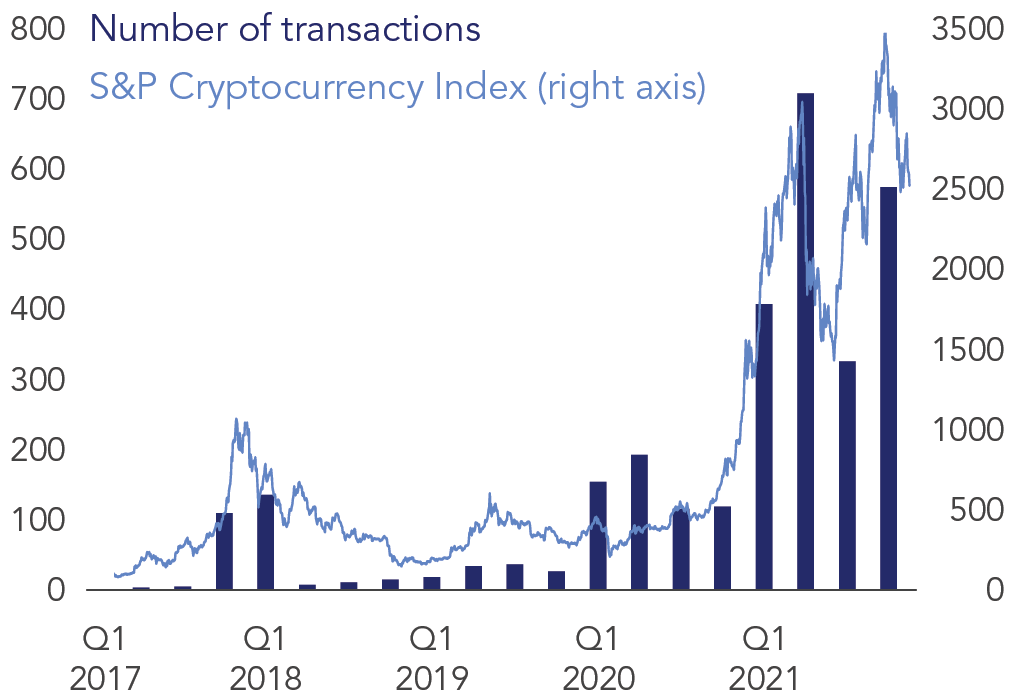

Digital-asset platforms and other intermediaries play important roles in the cryptocurrency ecosystem. They facilitate trading between buyers and sellers, engage in large volumes of daily transactions, and have recently expanded to provide more complex financial services. However, the extent of their activities and the potential risks they pose to financial stability are still largely opaque to regulators. Using Nationwide Multistate Licensing System & Registry (NMLS) Money Services Businesses (MSB) Call Report data, this brief provides an early look into the activities of these intermediaries, such as information on the size and volume of digital-asset transactions as well as aggregate balance sheet details. We find a high degree of market concentration, with major intermediaries not only accounting for the majority of transaction volumes but also holding the largest amounts of customers’ digital assets. Finally, we identify significant data gaps that remain with respect to the oversight of these digital-asset intermediaries and the financial-stability risks that may emerge from them (Brief no. 23-02).