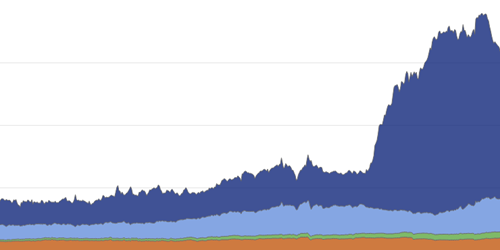

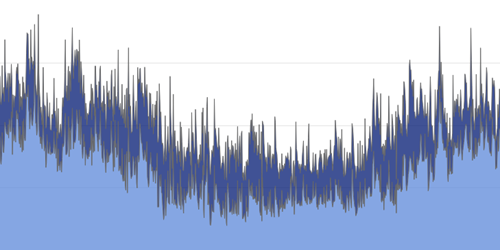

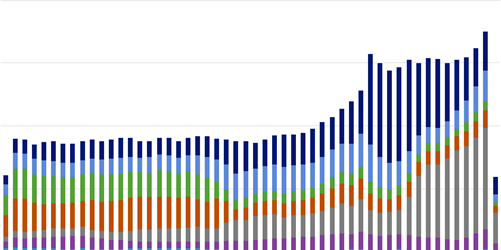

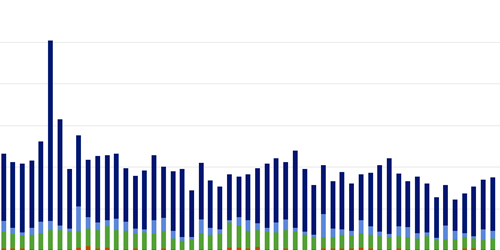

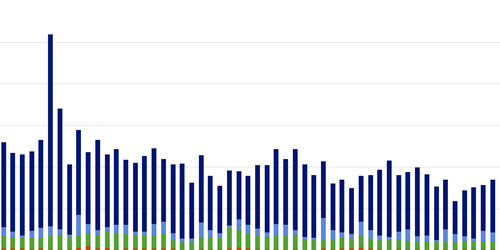

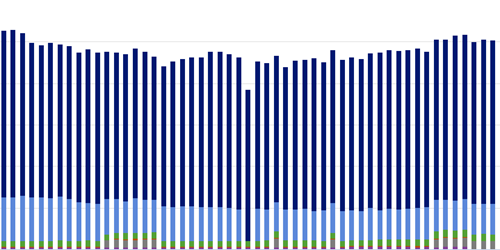

Primary Dealer Failures To Receive By Collateral Type

Collateral

Short-term funding markets often require that borrowers pledge securities as collateral against the possibility they may default on a loan. Types of collateral vary and can influence the rate of return charged for short-term funding and the willingness of lenders to extend such funding. The types of securities that appear as collateral can also indicate the security positions for which borrowers need financing. These charts present insights into the types of collateral used to secure funding across various short-term funding markets.

Primary dealer failures to receive by collateral type

Aggregate failures to receive securities for primary dealers broken out by type of collateral Mnemonics

Skip the ChartPrimary dealers serve as intermediaries in securities markets, receiving securities from sellers and delivering them to buyers. They also serve a unique role in purchasing Treasury securities at auction and acting as a counterparty to the Federal Reserve. In general, sellers have a limited time to deliver securities to settle any obligations they have made to primary dealers. For a variety of reasons, sellers may be unable to meet these obligations—for instance, if they sell a security short that they do not own and are then unable to obtain the security for delivery. The unmet obligation to a dealer is recorded as a failure to receive. The seller may be subject to settlement charges as a result.

Failures to receive are more common when there is underlying illiquidity in the securities market, which makes it more difficult for short-sellers to buy the securities they are obligated to deliver. High failures to receive in an asset class may indicate underlying

illiquidity in that asset class. Failures can also cascade: one firm failing to receive a security promised to another may cause the second firm to fail on obligations to a buyer. These cascading failures can exacerbate any lack of liquidity in the underlying security.

Series Used

This OFR monitor is presented solely for informative purposes and should not be relied upon for financial decisions; it is not intended to provide any investment or financial advice. If you have any specific questions about any financial or other matter please consult an appropriately qualified professional. The OFR makes no warranty, express or implied, nor assumes any legal liability or responsibility for the accuracy, completeness, reliability, and usefulness of any information that is available through this website, nor represents that its use would not infringe on any privately owned rights.

Disclaimer Regarding Non-OFR Data and InformationFor convenience and informational purposes only, the OFR may provide links and references to nongovernment sites. These sites may contain information that is copyrighted with restrictions on reuse. Permission to use copyrighted materials must be obtained from the original source and cannot be obtained from the OFR or from the U.S. Treasury Department. The OFR is not responsible for the content of external websites linked to or referenced from this site or from the OFR web server. The U.S. government, the U.S. Treasury Department, the Financial Stability Oversight Council, and the OFR neither endorse the data, information, content, materials, opinions, advice, statements, offers, products, services, presentation, or accuracy, nor make any warranty, express or implied, regarding these external websites. Please note that neither the U.S. Treasury Department nor the OFR controls, and cannot guarantee, the relevance, timeliness, or accuracy of third-party content or other materials. Users should be aware that when they select a link on this OFR website to an external website, they are leaving the OFR site.

Suggested CitationOffice of Financial Research, “OFR Short-term Funding Monitor,” refreshed daily, https://www.financialresearch.gov/short-term-funding-monitor/ (accessed ).