U.S. MMFs' Investments in the Repo Market

The Money Market Fund data presented are OFR-derived aggregates on an ultimate parent basis of data reported on Form N-MFP, Item C1.

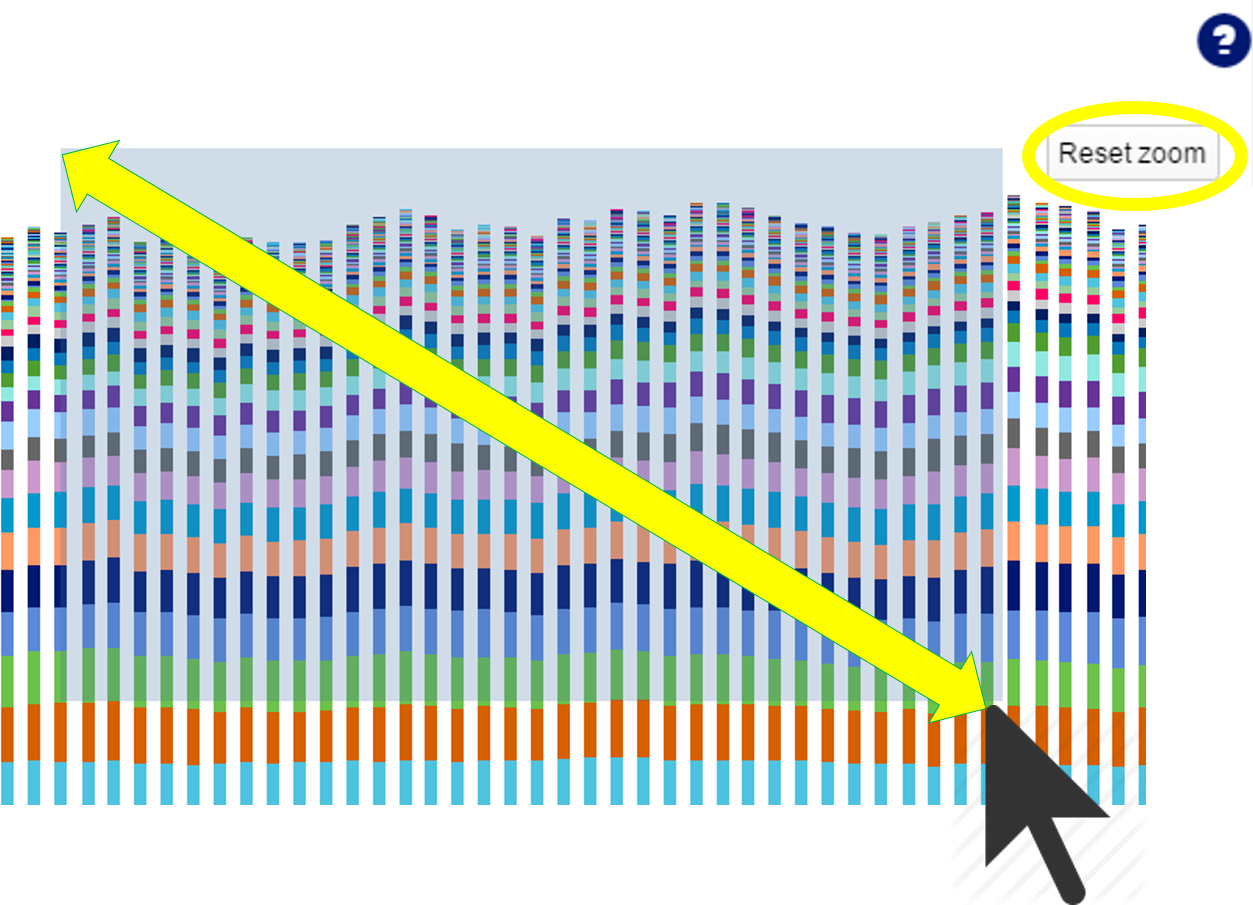

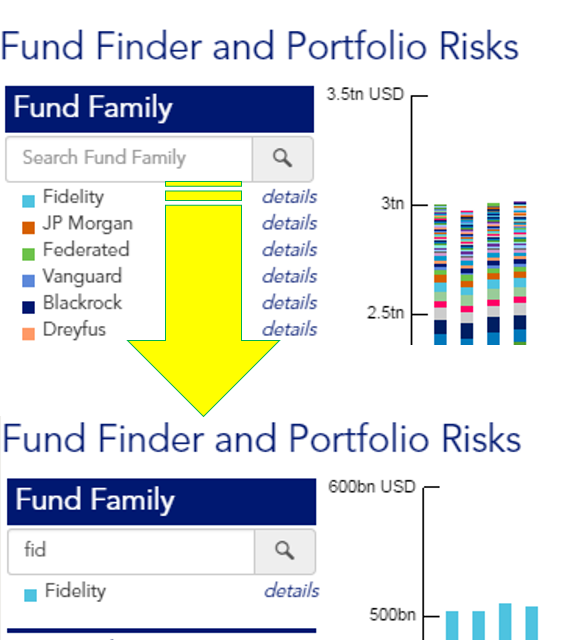

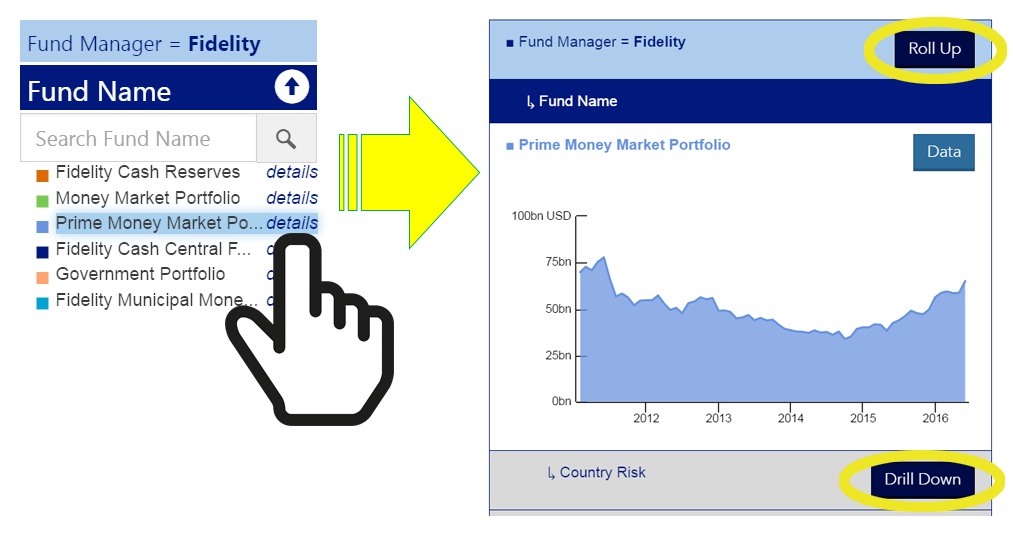

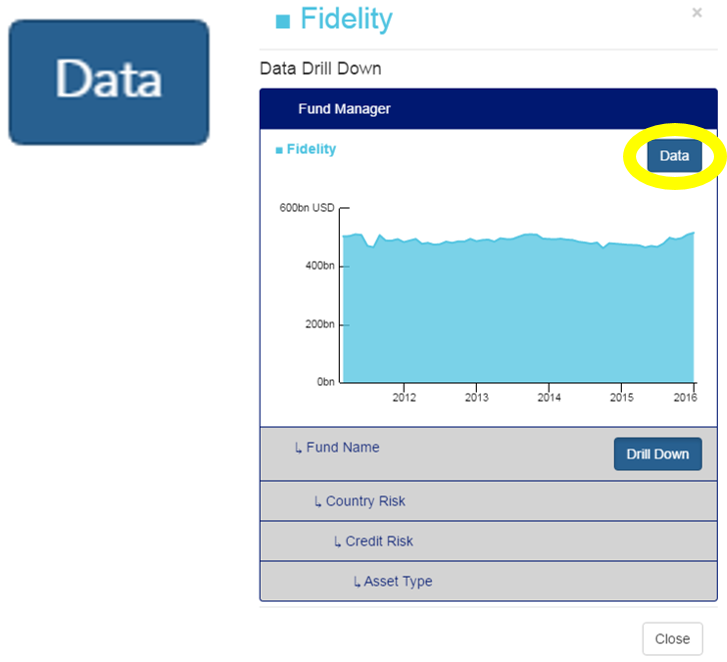

This monitor is designed to track the investment portfolios of money market funds by funds' asset types, investments in different countries, counterparties, and other characteristics. Users can view trends and developments across the MMF industry. Data are downloadable and displayed in six interactive charts. The reference guide contains examples of how to use the monitor and additional information.

What is a Repurchase Agreement - Repo

A repurchase agreement, or a repo, is the sale of a security in exchange for cash, with a commitment to buy it back again at a set price and at a set time. Repos are usually overnight, but they can be longer. They thus resemble short-term cash loans backed by collateral.See more: OFR's Repo Market Reference Guide

How are MMFs categorized

MMFs report their category in Form N-MFP by choosing from several options:- Treasury

- Government/Agency

- Exempt Government

- Prime

- Single State

- Other Tax Exempt

Single State and Other Tax Exempt Funds are combined into the “Tax Exempt” category. The funds in this category invest mainly in securities exempt from local income taxes. Usually, these are securities issued by local governments or municipal entities.

See more: SEC's Form N-MFP

What are repos with the Federal Reserve

The Federal Reserve (Fed) uses repurchase agreements, also called “repo” or “RRP", to help adjust the cash supply in the economy.When the Fed conducts a repo with an MMF, it sells securities with an agreement to buy them back at a later date. The Fed borrows cash from MMFs, which reduces the cash in circulation.

See more: New York Fed's FAQ, OFR's Repo Market Reference Guide

What are money market funds and fund managers

Money market funds are a type of a mutual fund and are regulated by the SEC. Typically, money market funds issue shares in the public market and sell them to all types of investors. (A small group of funds do not issue public shares.) The fund invests that cash in short-term debt securities from issuers such as banks, nonfinancial corporations, municipalities and federal and local governments. Money market funds typically rely upon third parties to carry out business activities, such as an investment manager, administrator, custodian, principal underwriter, and transfer agent.See more: SEC: Money Market Funds, OFR's MMF Monitor Guide

What is a prime fund, and what are retail and institutional funds?

Money market funds, a type of mutual fund, are regulated by the Securities and Exchange Commission. Money market funds that primarily invest in corporate debt securities are called prime funds.Since the adoption of money market reforms in 2014, prime funds are further divided into two categories based on the type of investor. Prime funds limited to individual investors are labeled “Prime Retail” in the OFR’s U.S. Money Market Fund Monitor. These funds are allowed to maintain a stable net-asset value per share. All other prime funds, labeled “Prime Institutional,” have a floating net asset value per share that fluctuates with the market value of the fund’s assets.

See more: SEC's Form N-MFP

What is a government fund, and what are fees and gates?

The OFR's MMF Monitor treats the Treasury, Government/Agency, and Exempt Government categories as “Government” funds because of their similar asset composition. These funds invest most of their assets in cash, government securities, and repurchase agreements (repos) backed by these securities.Money market fund reforms in 2014 introduced a new definition of Government money market funds. These funds may also choose not to adopt liquidity fees and redemption gates. Liquidity fees are imposed to discourage investors from withdrawing their assets from the fund and potentially to limit the fund’s need to sell off its assets. Similarly, redemption gates are established to reduce the potential for forced sales; they temporarily suspend the ability of investors to make withdrawals from the fund. Although not required by law, some Government funds have voluntarily imposed liquidity fees and redemption gates. The OFR’s MMF Monitor labels these funds as “Government (Fees and Gates).” Those Government funds which do not impose fees or gates are labeled as “Government (No Fees and Gates).” These funds are categorized on Form N-MFP as “Exempt Government.“

See more: SEC's Form N-MFP

What is a tax exempt fund, and what are retail and institutional funds?

Money market funds, a type of mutual fund, are regulated by the Securities and Exchange Commission. Money market funds that primarily invest in securities exempt from local income taxes are called tax exempt funds. Usually, these are securities issued by local governments or municipal entities.Since the adoption of money market reforms in 2014, tax exempt funds are further divided into two categories based on the type of investor. Tax exempt funds limited to individual investors are labeled “Tax Exempt Retail” in the OFR’s U.S. Money Market Fund Monitor. These funds are allowed to maintain a stable net-asset value per share. All other tax exempt funds, labeled “Tax Exempt Institutional,” have a floating net asset value per share that fluctuates with the market value of the fund’s assets.

See more: SEC's Form N-MFP