The Macroeconomic Consequences of Capital Constraints

Published: January 22, 2026

Abstract

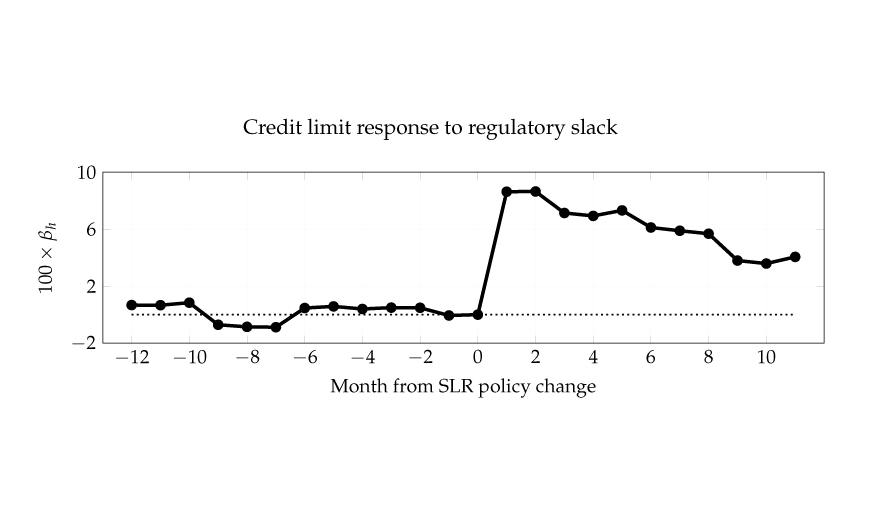

This paper quantifies the effect that regulatory capital requirements have on bank lending and real economic activity. Exploiting a change in capital requirements by the Federal Reserve at the onset of the pandemic recession, it establishes causally that looser requirements increased the ability for banks to extend credit to consumers. On average, banks that received relatively more balance sheet space from the policy change passed this along to their customers in the form of relatively higher credit limits from Q2 2020 to Q1 2021. This also led to relatively higher credit card borrowing among these customers. Using a general equilibrium quantitative model calibrated to match the empirical findings, the paper shows that absent the Federal Reserve policy change, consumption would have fallen by an extra 2.7% in the three years following the pandemic recession. Motivated by these estimates, this paper evaluates the efficacy of countercyclical capital requirements and finds that such policy could lower consumption volatility over the business cycle by as much as 12%.