OTC Intermediaries

Published: August 29, 2018

Revised: May 24, 2021

This paper estimates the systemic effects of exit by a key over-the-counter (OTC) intermediary. In the model, risk-averse traders are connected by a core-periphery network. If traders are also averse to concentrated bilateral exposures, then the incomplete network prevents full risk sharing. The impact of the network structure on prices is quantified using proprietary data on all credit default swap transactions in the United States from 2010 to 2013. There are a small number of key OTC intermediaries whose exit can move markets dramatically. Eliminating one of these intermediaries leads to over a 20 percent increase in credit spreads. The Internet Appendix includes extensions of the model. (Working Paper no. 18-05)

Abstract

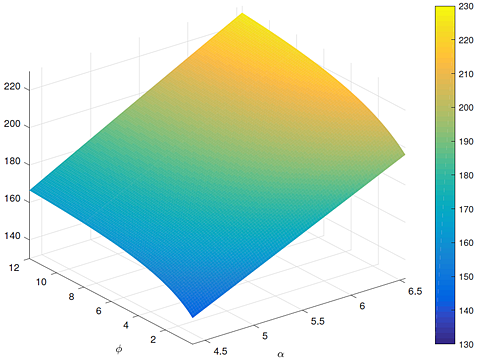

Over-the-counter (OTC) markets for financial assets are dominated by a relatively small number of core intermediaries and a large number of peripheral customers. In this paper, we develop a model of trade in a core-periphery network and estimate its key structural parameters using proprietary credit default swap data from the Depository Trust & Clearing Corporation (DTCC). Using our calibrated model, we provide quantitative estimates of: (1) the effect of network frictions on the level of OTC derivatives prices; (2) the key determinants of cross sectional dispersion in bilateral prices; and (3) how prices and risk-sharing change in response to the failure of a dealer.

Keywords: OTC markets, networks, intermediaries, dealers, credit default swaps, risk sharing