Competitive Pay and Excessive Manager Risk-taking

Published: April 10, 2018

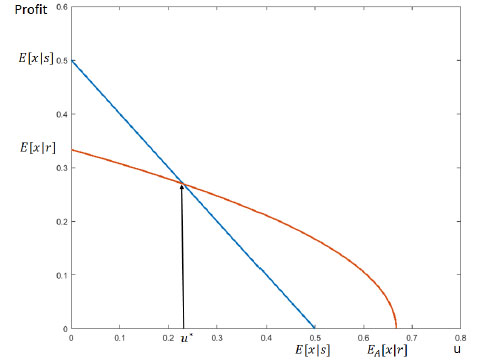

This paper assesses whether compensation plans can drive excessive risk-taking. It develops a model showing that principals offer contracts incentivizing less risky behavior when the market for managers is sluggish. But hot labor markets result in contracts that incentivize risk-taking. The market for executive talent heats up for larger projects and during financial bubbles, when debt funding increases. The results suggest policymakers should consider the impacts of compensation and corporate governance policies on competition for managers. (Working Paper no. 18-02)

Abstract

Since the 2007-09 financial crisis, researchers have debated whether compensation plans drove excessive risk-taking or financial managers simply underestimated the risks of various investments. Through a principal-agent model with heterogeneous beliefs, we show that principals offer contracts that incentivize safe behavior when competition for managerial talent is low. However, intense competition results in contracts that incentivize risk-taking. We find that factors that increase the intensity of competition include greater search efficiency, larger project scales, and higher debt funding, all of which may be prevalent during a financial bubble.

Keywords: competition, compensation contracts, overoptimism

JEL Codes: D86, G38, M12