Does Unusual News Forecast Market Stress?

Published: April 20, 2016

This paper investigates the use of automated text analysis by computers as a tool for monitoring financial stability. The authors find negative sentiment extracted from tens of thousands of news articles about 50 large financial services companies is useful in forecasting volatility in the stock market. The method, which also considers the “unusualness” of news, may help anticipate stress in the financial system. (Working Paper no. 16-04)

Abstract

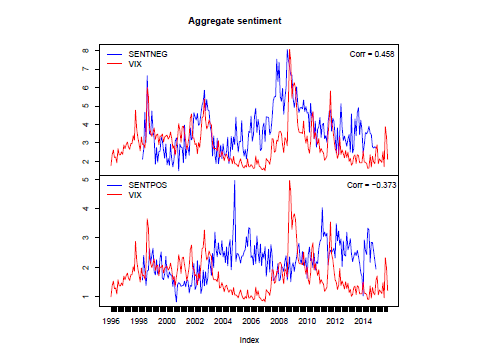

We find that an increase in the “unusualness” of news with negative sentiment predicts an increase in stock market volatility. Our analysis is based on more than 360,000 articles on 50 large financial companies, mostly banks and insurers, published in 1996–2014. We find that the interaction between measures of unusualness and sentiment forecasts volatility at both the company-specific and aggregate level. These effects persist for several months. The pattern of response of volatility in our aggregate analysis is consistent with a model of rational inattention among investors.