Form PF and Hedge Funds: Risk-measurement Precision for Option Portfolios

Published: March 23, 2016

This paper examines the precision of Form PF in measuring the risk hedge funds pose to the financial system. Hedge funds and other private funds now file Form PF with the Securities and Exchange Commission. The paper extends the methodology of a 2015 OFR working paper and finds that options significantly weaken the risk-measurement tolerances in Form PF. (Working Paper no. 16-02)

Abstract

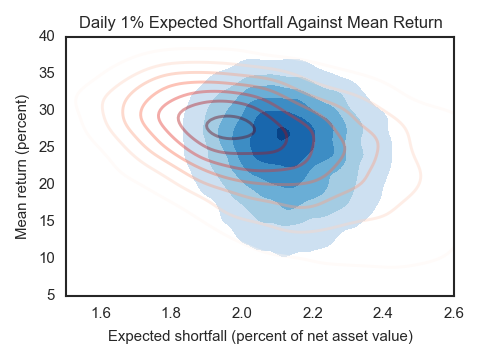

The Securities and Exchange Commission’s Form PF is the implementation of Congress’s post-crisis mandate for risk reporting by hedge funds to help protect investors and monitor systemic risk. We extend the methodology of Flood, Monin, and Bandyopadhyay [2015] to assess the risk measurement tolerances of Form PF for portfolios including options exposures. We generate a range of simulated portfolios of equities and equity options, where the weights are calibrated so that portfolios appear identical on Form PF. We assess the measurement tolerances of Form PF by examining the minimum-maximum range of actual risk exposures as measured directly from portfolio details. We find that the possible range of variation is significant. For portfolios that include options but do not report value at risk on Form PF, the range is especially large.

Keywords: Hedge funds; Form PF; data quality; systemic risk; risk monitoring