Bounding Wrong-Way Risk in Measuring Counterparty Risk

Published: August 19, 2015

This paper proposes a new method for bounding the impact of "wrong-way risk" on counterparty credit risk measurement for a portfolio of derivatives. Wrong-way risk refers to the possibility that a counterparty’s default risk increases with the market value of the exposure. (Working Paper no. 15-16)

Abstract

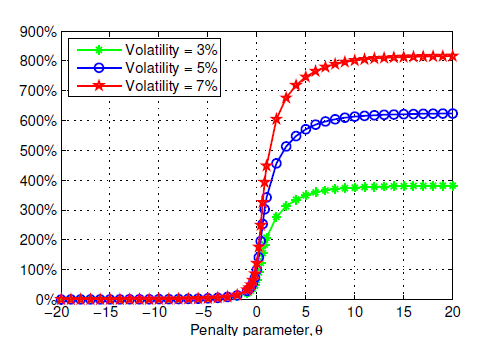

Counterparty risk measurement integrates two sources of risk: market risk, which determines the size of a firm’s exposure to a counterparty, and credit risk, which reflects the likelihood that the counterparty will default on its obligations. Wrong-way risk refers to the possibility that a counterparty’s default risk increases with the market value of the exposure. We investigate the potential impact of wrong-way risk in calculating a credit valuation adjustment (CVA) to a derivatives portfolio: CVA has become a standard tool for pricing counterparty risk and setting associated capital requirements. We present a method, introduced in our earlier work, for bounding the impact of wrong-way risk on CVA. The method holds fixed marginal models for market and credit risk while varying the dependence between them. Given simulated paths of the two models, we solve a linear program to find the worst-case CVA resulting from wrongway risk. The worst case can be overly conservative, so we extend the procedure by penalizing deviations of the joint model from a baseline model. By varying the penalty for deviations, we can sweep out the full range of possible CVA values for different degrees of wrong-way risk. Our method addresses an important source of model risk in counterparty risk measurement.

Keywords: credit valuation adjustment, counterparty credit risk, wrong-way risk, iterative proportional fitting process (IPFP)