Size Alone is Not Sufficient to Identify Systemically Important Banks

Published: October 26, 2017

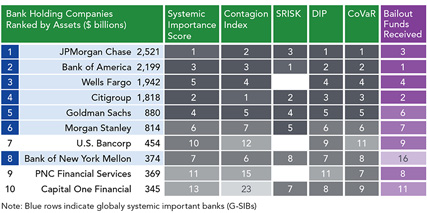

How can regulators determine which banks to hold to tougher standards to reduce risks to the financial system? U.S. bank regulators often use asset-size thresholds, assuming that larger banks pose more risks than smaller banks. This OFR viewpoint argues that a multifactor approach is superior to considering size alone in determining systemic importance. (Viewpoint Paper no. 17-04)

Summary

Some banks have been subject to enhanced regulation since the 2007-09 financial crisis because the failure of any one of them could pose risks to the financial system. Many regulations use the amount of bank assets to identify and categorize such firms, but size alone does not equate to risk to financial stability. An alternative approach, used to identify global systemically important banks (G-SIBs), relies on multiple measures, not just size. This analysis suggests that using such a multifactor approach to identify non-G-SIB U.S. banks for enhanced regulation — one focused on systemic importance — would be an improvement on the asset-size thresholds now used.