Risk Spotlight: Risk from the Real Estate Market is Limited, but Changes in Occupancy and Prices May Increase the Risk

Published: March 23, 2023

Views and opinions expressed are those of the authors and do not necessarily represent official positions or policy of the OFR or Treasury.

Neither the commercial real estate (CRE) nor the residential real estate market poses a significant risk to the U.S. financial system in the foreseeable future. The CRE market performed well throughout most of 2022, but it is now showing weakness. Home prices began to soften in 2022, in conjunction with the Federal Reserve’s interest rate increases. While these markets have been resilient until recently, their strength will be tested if a recession occurs.

Commercial Real Estate

Financial-stability risks arising from the CRE market are expected to be limited overall. The market performed well overall during most of 2022, exhibiting strong occupancy rates plus rising rents and property values. However, the CRE market weakened during the latter part of 2022 in response to the Federal Reserve’s interest rate increases. The weakening of the CRE market has further accelerated during early 2023.

The Federal Reserve’s actions to tighten monetary conditions through interest rate increases had two primary impacts on CRE:

- Rising interest rates reduced the present value of properties with fixed cash flows.

- Rising interest rates made the financing of CRE purchases more difficult.

The slowing economy also reduced overall demand for goods and services, such as real estate. In response, there has been a decline in demand for office space as companies, especially in the tech sector, reduce employment. The largest demand declines and the highest vacancy rates have occurred in tech centers such as San Francisco and Seattle, but the decline of office space demand has occurred nationwide. The long-term impact of the work-from-home (WFH) phenomenon remains uncertain and may be a major driver of the demand—or lack of demand—for office space in coming years.

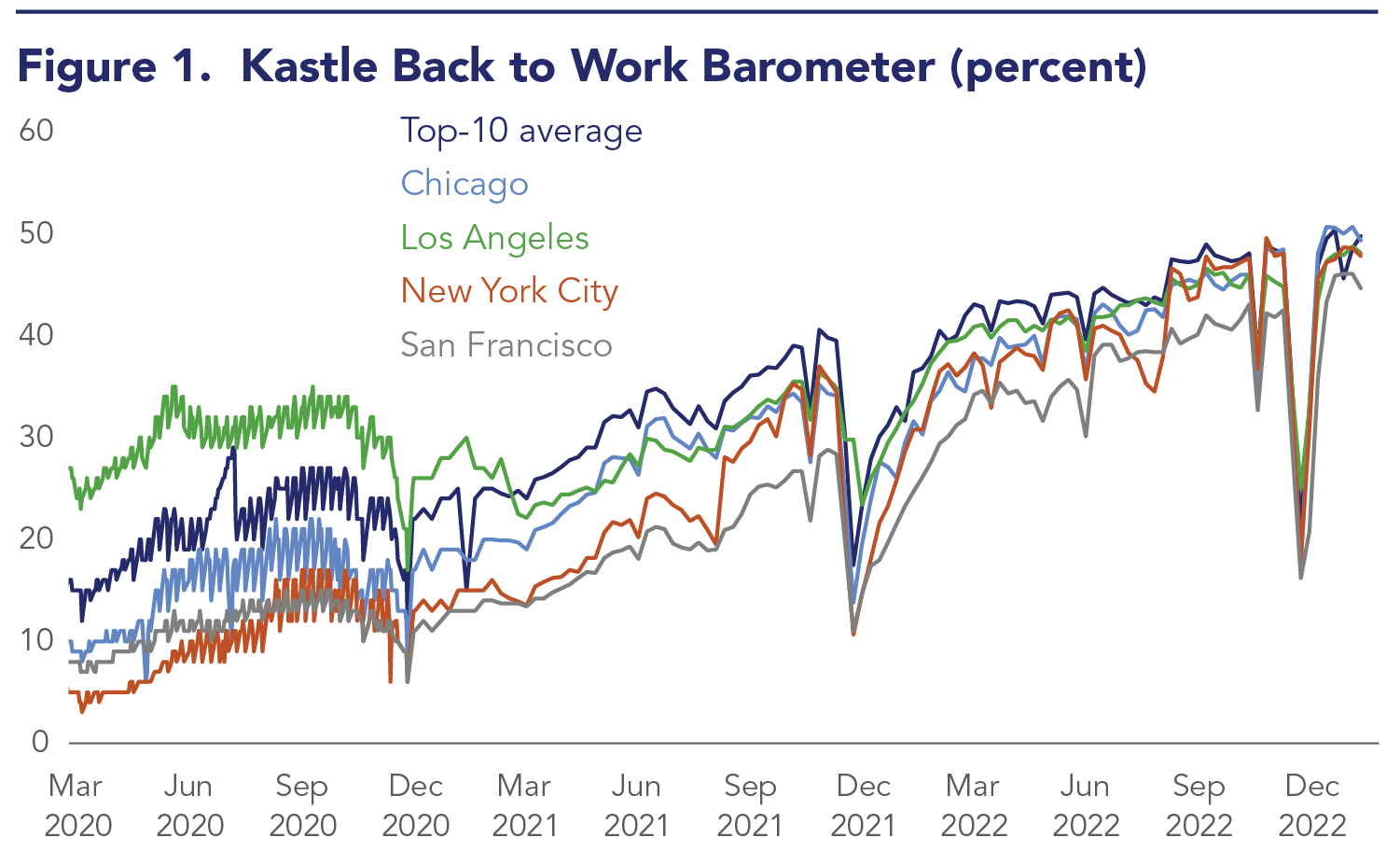

On the positive side, Kastle Systems’ national Back to Work Barometer (which tracks average office occupancy rates in 10 major cities) moved above the 50% mark for the first time on January 25, 2023—a new post-COVID high (see Figure 1). The Back to Work Barometer continues to hover in the 50% area. Continuing demand for office space will be a primary driver of the future performance of the office sector.

Note: Data as of February 2023. Relative to Pre-COVID baseline.

Sources: Haver Analytics, Office of Financial Research

Demand for multifamily housing has also modestly declined, with rental rates now falling in many markets. The multifamily market has shown exceptional rent growth in recent years, so a market slowdown is a welcome respite to renters. In response, as reported by MSCI Real Assets, multifamily property values incurred a 7.6% price decline during the three months ending January 2023 (see Figure 2). However, the multifamily market remains supported by a constrained supply in most areas of the country.

Note: Data as of January 2023. Shaded areas are U.S. recessions. Dec. 31, 2009 = 100.

Sources: MSCI Real Assets, Office of Financial Research

Industrial space and multifamily properties performed well in 2022. Heavy demand is driving industrial-space development, and new space may not fully satisfy growing demand. The performance of retail space has improved during the COVID-19 pandemic and is expected to continue improving into the future because supply remains constrained and space demand is modestly growing. Weaker regional shopping malls continue to be the most problematic part of the CRE market.

Given economic conditions and rising interest rates, overall CRE prices are now declining, with a 6.3% decline in the RCA CPPI index during the three months ending in January 2023. Declining property values will cause loan performance degradation at CRE lenders—especially those that were most aggressive in their lending terms, such as those with high loan-to-value ratios. Most capitalization rates are rising in tandem with interest rates, causing the values of some properties to decline.

The office sector in particular has seen challenges, with owners of high-profile properties in multiple major downtowns refusing to further support these troubled properties. However, given the large increase in property values that has occurred in recent years, such challenges are unlikely to result in widespread lender credit losses, except among the weakest properties. While CRE credit impairments will rise during coming quarters, they are unlikely to cause meaningful stress at more conservative lenders, such as banks and insurance companies.

Residential Real Estate

Household mortgage debt is not the risk to financial stability that it was during the 2007-09 financial crisis, for three reasons:

- The household sector is much less leveraged now than before the crisis.

- New mortgage originations favor Fannie Mae and Freddie Mac’s conventional loan programs; the mortgages written in these programs have tighter underwriting standards than the mortgages originating prior to the crisis.

- The high percentage of fixed-rate loans indicates that few borrowers are likely to experience payment shocks associated with interest rate resets on adjustable-rate mortgages. These payment shocks were common before the crisis.

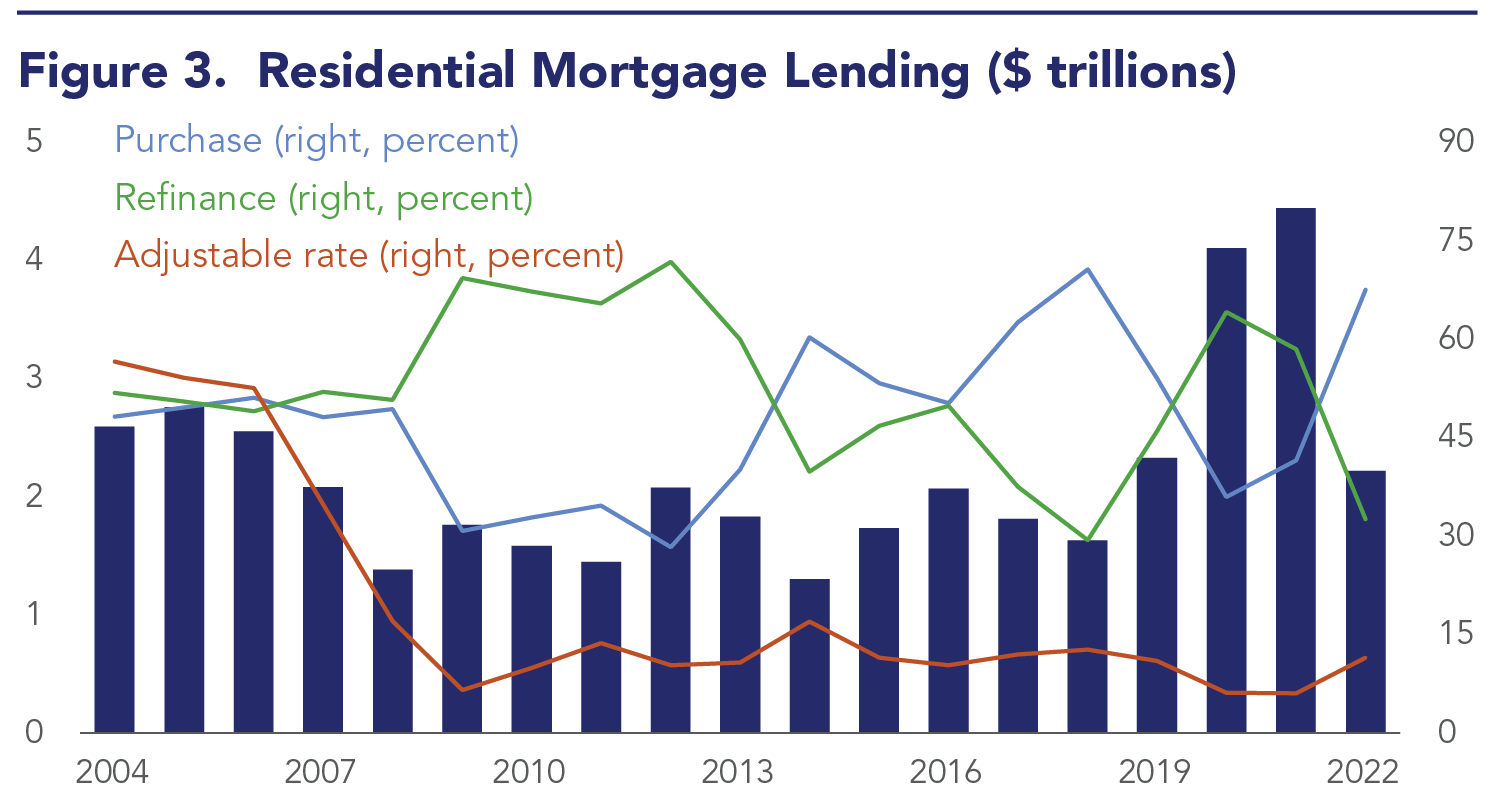

That said, home affordability is now the lowest it has ever been, as home price growth is outpacing wage growth. Since the pandemic, home prices have risen to record levels. The increased demand for homes led to dramatic increases in mortgage activity in 2020 and 2021. Homeowners also refinanced their mortgages to lower-rate loans during this time. Mortgage volume for 2022 was less than 50% of the 2021 volume. The majority of new loans in 2022 were made to purchase homes, while refinancing activity dropped due to rising interest rates. Finally, adjustable-rate mortgage volume has begun to increase after losing popularity following the 2007-09 financial crisis (see Figure 3).

Note: Originations represent first-lien mortgages only.

Sources: Inside Mortgage Finance, Office of Financial Research

The risk to financial stability stemming from the housing market relates to home values. Record housing prices resulted in higher monthly payments for new homeowners with mortgage debt during this period. Therefore, a correction in home prices to historic levels, depending on its speed and severity, could pose two risks to U.S. financial stability:

- Falling home prices could erode household wealth and dent consumer confidence and spending.

- Reduced loan-to-value could generate defaults, distressed sales, and loan losses.

However, given the tight housing supply, declining home prices are not an immediate concern.

Read more about the real estate market and other sources of risk to financial stability in OFR’s 2022 Annual Report to Congress.