Five Risk Areas That Financial Regulators Should Watch in 2023

Published: March 7, 2023

Views and opinions expressed are those of the authors and do not necessarily represent official positions or policy of the OFR or Treasury.

In its 2022 Annual Report to Congress, the Office of Financial Research discussed how inflation, monetary tightening, and market volatility elevated financial system risk in 2022. As we begin 2023, OFR’s senior financial analysts Dagmar Chiella, Hashim Hamandi, and Ruth Leung explain five areas of risk they’re currently monitoring.

1. The global economy is experiencing high inflation driven by strong demand, following the Covid-19 pandemic and disruptions in the supply of energy and other commodities.

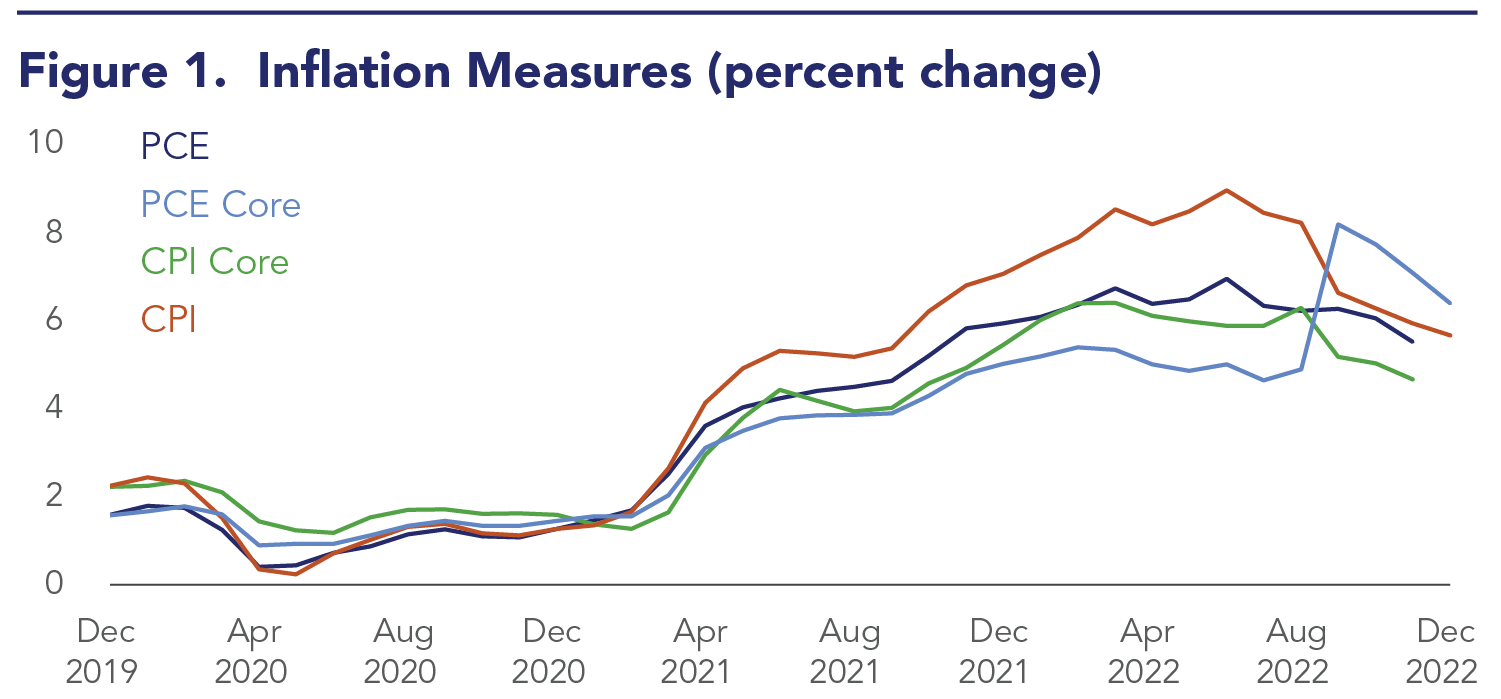

The global economy is experiencing high inflation not seen in decades. This is driven by strong consumer demand and disruptions in the supply of energy and other commodities. Despite recent declines in the Consumer Price Index (CPI) and stabilization of energy and commodities markets, inflation continues to run high globally. In the United States, the CPI for January 2023 increased 6.4% year-over-year, before seasonal adjustment. Although this is lower than the peak value of 9.1% in June and July in 2022, it remains well above the Federal Reserve’s target rate of 2% inflation. Geopolitical factors and their associated uncertainties have also weighed on U.S. economic growth and led to considerable volatility in financial markets. That said, the tightening of financial conditions was predominantly a reflection of interest rate hikes and quantitative tightening.

Note: Chain-type price index, percent change from a year ago, monthly, seasonally adjusted. PCE data through Nov. 2022. CPI data through Dec. 2022.

Sources: FRED, Office of Financial Research

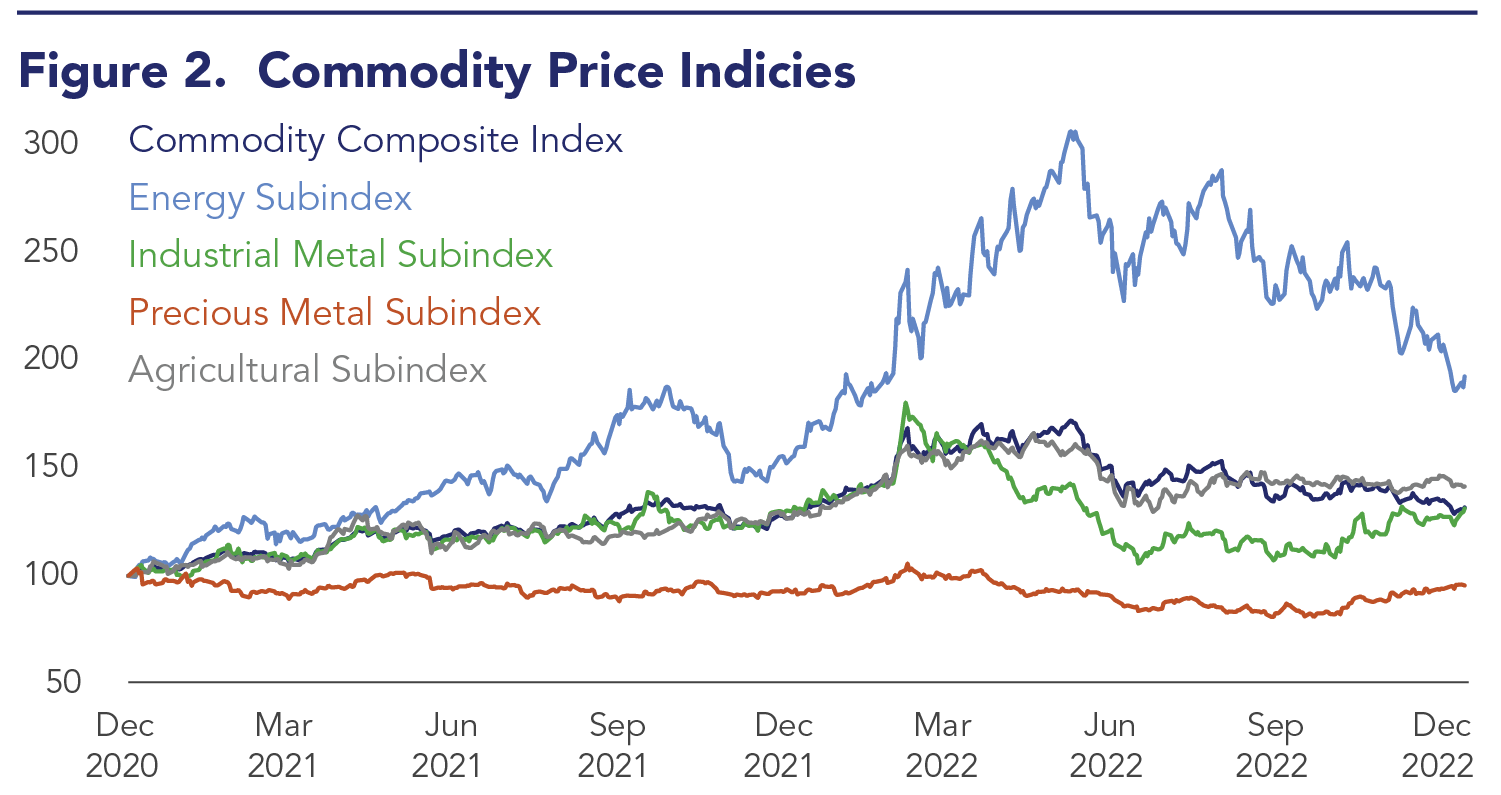

2. Price volatility across commodities translates into several financial-market risks.

Financial-stability risks emanating from commodities markets and their transmission channels are elevated. The most direct of these transmission channels is price instability. For example, although energy prices have stabilized recently, higher energy prices are passed down to consumers, which in turn affects spending and economic growth. The reopening of China’s economy following its pandemic lockdown will likely increase the demand for energy, potentially adding an element of uncertainty to energy markets. A related concern is U.S. dependence on foreign commodities, including energy, rare-earth metals, and agricultural products. Russia’s war against Ukraine has particularly exacerbated the price stability of such commodities.

Note: Data is indexed to 12/31/2020=100

Source: Bloomberg Finance L.P., Office of Financial Research

3. Market risk may reinforce other financial-stability vulnerabilities.

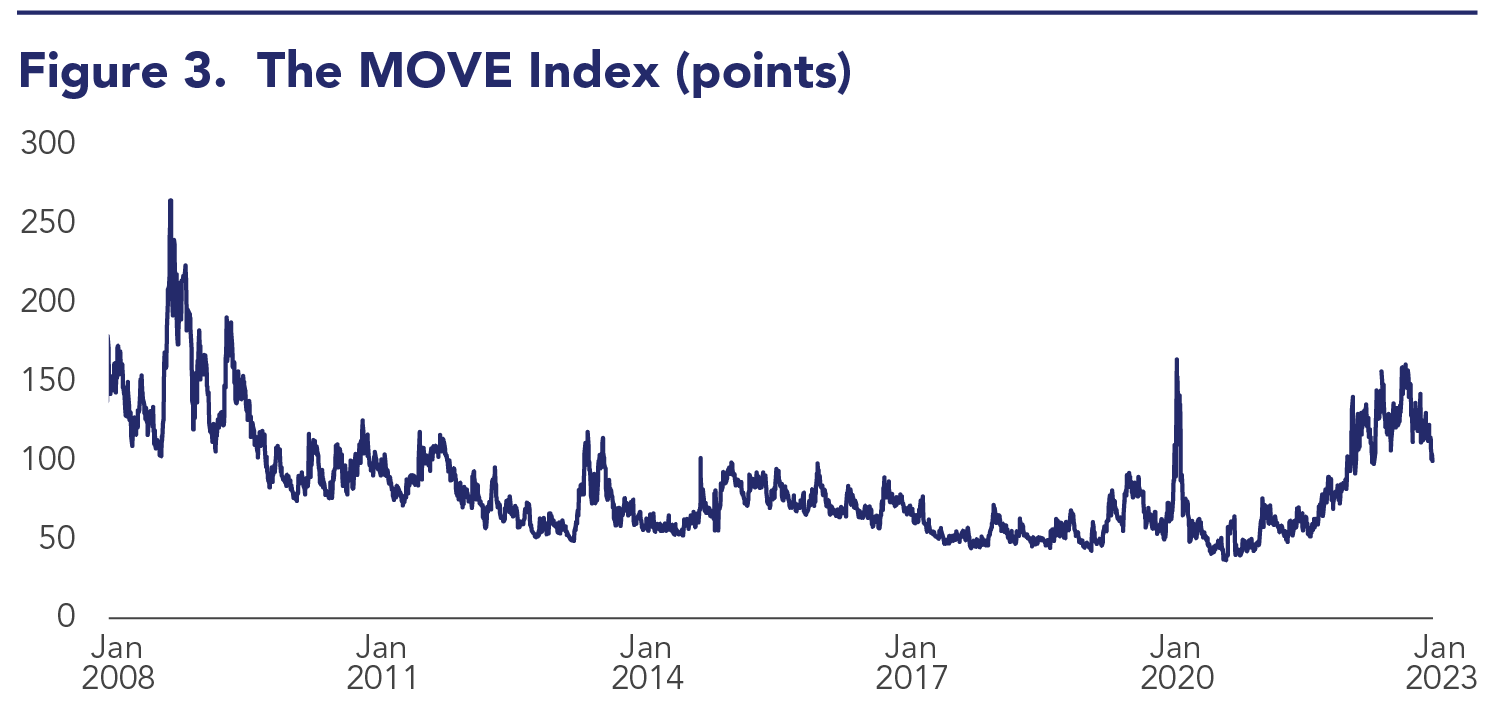

Inflationary pressures and tighter monetary policy led to sharp increases in risk-free rates, resulting in higher price volatility and large losses for both equity and fixed income investors. The ICE Bank of America U.S. Bond Market Option Volatility Estimate Index (MOVE Index), a measure of implied volatility in U.S. Treasury securities, reached 160 in October 2022. This is a level only exceeded twice before in history: (1) at the beginning of the COVID-19 pandemic in March 2020 and (2) during the 2007-09 financial crisis. While this implied volatility measure has trended lower in recent weeks, it remains well above its five-year average of 72.

Note: The MOVE (ICE BofAML U.S. Bond Market Option Volatility Estimate) Index measures the markets expectation of implied volatility of the U.S. bond market using 1-month U.S. Treasury options weighted for 2, 5, 10 and 30 year contracts.

Sources: Intercontinental Exchange Inc., Bloomberg Finance L.P., Office of Financial Research

Also, the U.S. Treasury yield curve remains inverted across most maturities. The term premium has not increased proportionally so far, due to expectations of a reversal in the Federal Reserve’s monetary policy in 2023, coupled with a still large Federal Reserve balance sheet.

In addition, as the central bank continues drawing down its balance sheet, market liquidity may become an issue. This is due to elevated debt levels and changes in the functioning of the bond market, including the ability of participants to quickly liquidate sizeable positions. Historically, primary dealers were the main source of liquidity, but since the 2007-09 financial crisis, growth in sovereign and corporate debt levels has outpaced primary dealers’ willingness and capacity to provide liquidity. Nonbank participants have stepped in as liquidity providers during normally functioning markets.

While market risk, or volatility in asset prices, is not the same as financial-stability risk, market risk may interact with and reinforce other vulnerabilities. The combined effects may in turn amplify financial-stability risk.

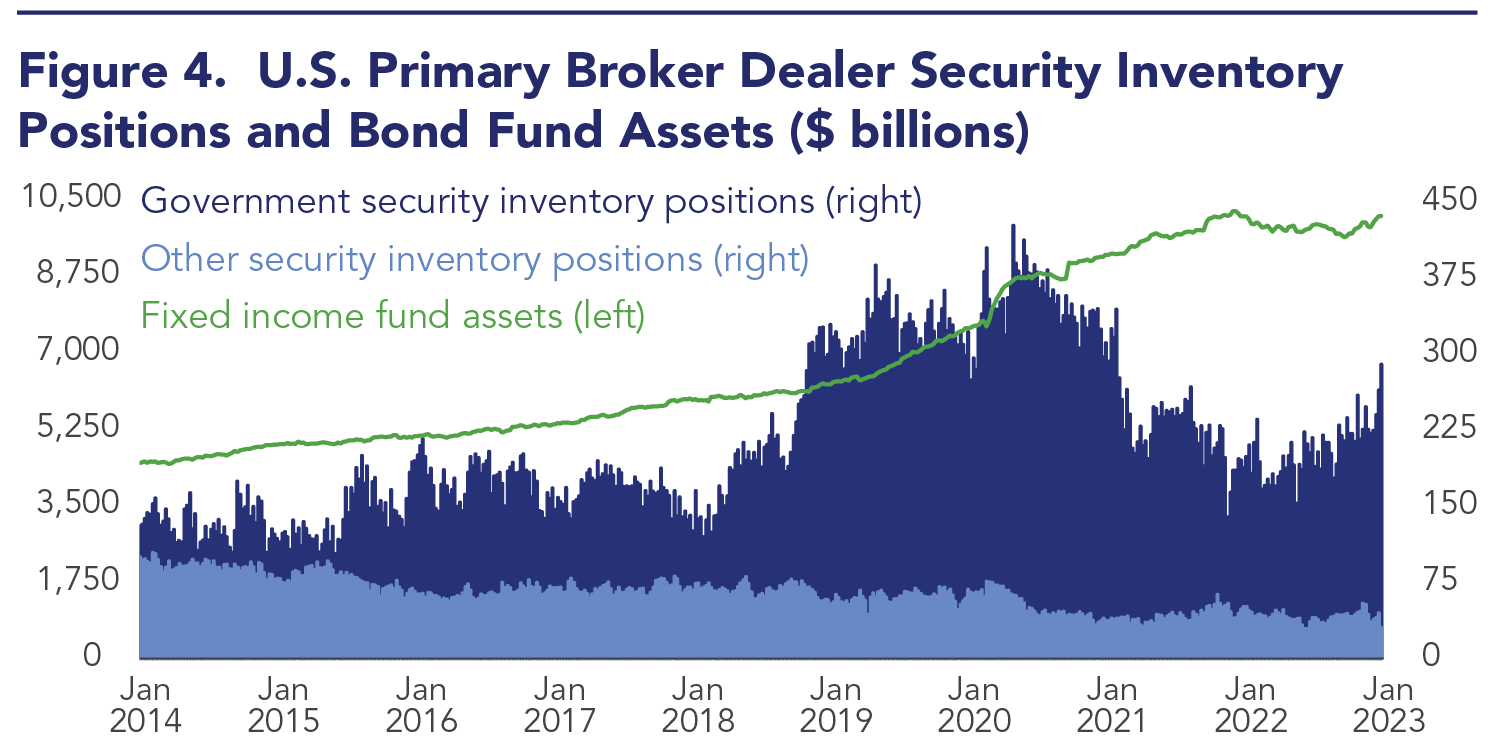

4. Further bond fund outflows may strain fixed income markets.

Note: Fixed income fund assets exclude funds that only report assets monthly or quarterly. Bond Fund assets include money market fund assets. Data through January 18, 2023.

Sources: Haver Analytics, Emerging Portfolio Fund Research, Federal Reserve Bank of New York Primary Dealers Report, Office of Financial Research

Bond funds, including bond exchange-traded funds, currently supply almost $6 trillion in financing to U.S. financial sector assets—more than four times their level in 2008. In comparison, depository institutions currently supply $26 trillion in financing—less than double their level in 2008. Bond funds are vulnerable to investor panic–driven runs in ways similar to money market funds and other cash management products that offer daily liquidity but have assets that take longer to liquidate on an orderly basis.

Bond fund flows are also sensitive to interest rate increases, with longer-duration portfolios having greater sensitivity. Inflation and rising interest rates in 2022 eroded returns on intermediate- and long-term bonds, leading to aggregate outflows of $464 billion—or about 9.5% of total assets. Despite the sizable fund outflows, available data suggests the outflows have been orderly and have not escalated into liquidity stress. However, continued uncertainty about inflation and interest rate policy changes may induce further bond fund outflows that could strain fixed-income markets.

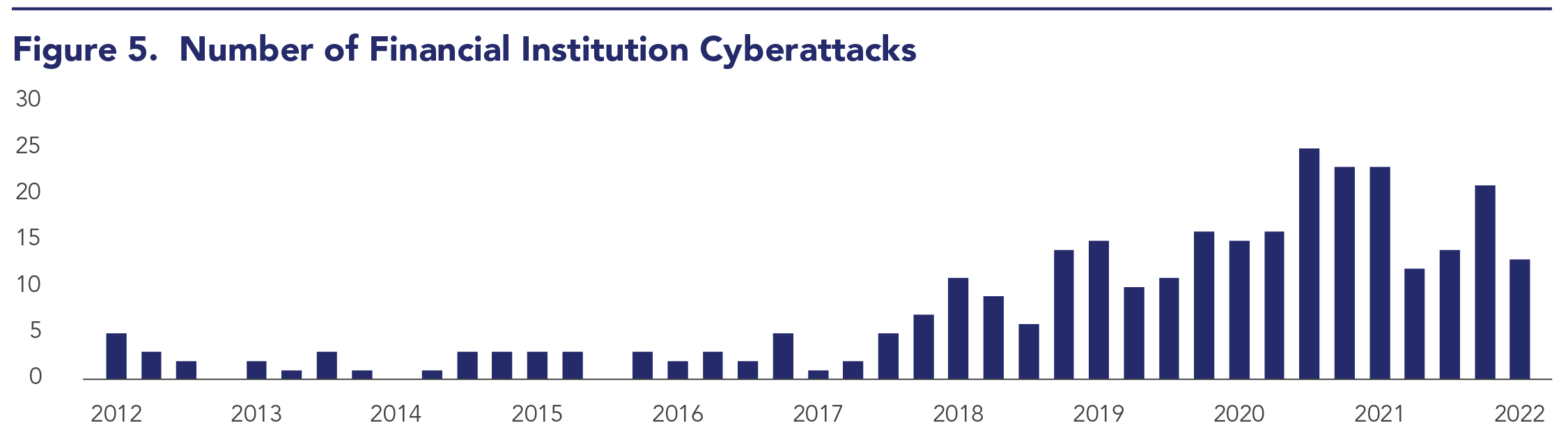

5. Cybersecurity risks are growing in frequency and costs.

Note: Figure shows cyber incidents targeting financial institutions (including FinTechs) that are included in the Carnegie Endowment timeline. The timeline does not aim to capture every single incident, but to provide an insight into key trends.

Sources: Carnegie Endowment for international Peace, Office of Financial Research

Although the growth of cybercriminal activity has slowed somewhat over the past year, cybercrime’s potential for outsize impact on the financial sector remains. Russia’s war against Ukraine has substantially increased the perceived risk of state-sponsored cyberattacks in the U.S. financial services sector.

Also, the insurance industry is increasingly deeming cybersecurity-related risks to be uninsurable. Private insurers are tightening terms and including language to specifically exclude the greatest tail risks from state-backed cyberattacks. The insurance group Lloyds of London is set to require that written insurance policies explicitly exclude state-backed cyberattacks from coverage. This reflects the general opinion in the insurance industry that the tail risks from a widespread state-backed attack are too large to be covered by reasonable premiums. An increase in uninsured losses would have implications for systemic risk.