Risk Spotlight: Central Counterparties - Lessons Learned from LME’s Nickel Market Closure

Published: February 13, 2023

Views and opinions expressed are those of the authors and do not necessarily represent official positions or policy of the OFR or Treasury.

In 2022, there were no reported defaults by central counterparties (CCPs) members or their clients, and there were also very few serious disruptions. One exception was the closure of the nickel market on the London Metal Exchange (LME). This blog post discusses the heighted risk factors that this incident exposed. A more detailed discussion is included in OFR’s 2022 Annual Report to Congress.

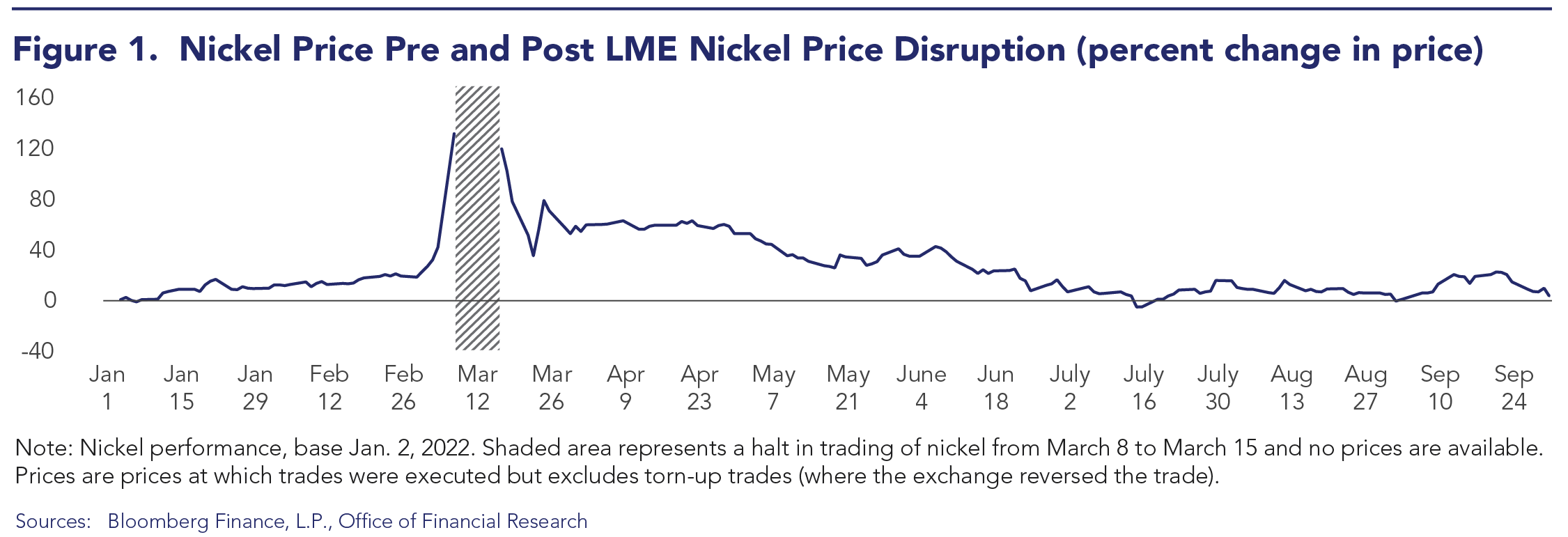

Nickel Prices Tripled, and Margins Were Insufficient to Cover a Default

On March 7 and 8, the price of nickel nearly tripled, from an opening price of $29,770 per metric ton on March 7 to a high of $101,365 per metric ton on March 8—an order of magnitude higher than the prior two-day price moves. This made the existing margin charges of $2,000 per metric ton insufficient to cover the CCP in the event of a default. As prices surged, the exchange decided to close the market and cancel some trades, rather than risk default by several of its members and their clients.

This incident is similar to the near collapse of the NASDAQ OMX electricity market in 2018. In that case, a single member accumulated a massive derivatives position that their initial margin could not cover when prices moved against them. The market remained open, but the member positions were closed out, and the other members were forced to contribute more to the guarantee fund to ensure that the shortfall could be covered.

Nickel Market Closure Exposed CCP’s Heightened Risk Factors

The LME’s nickel market closure highlighted two areas in which commodity CCPs may be subject to heightened risk factors:

- Price volatility in commodities is often significantly higher than in other product classes and requires correspondingly large initial margins to protect against potential default.

- The diversity of hedging instruments used by commodities trading firms is relatively wide, with positions potentially held among multiple CCPs and in uncleared instruments with multiple intermediaries.

This fragmentation of exposures can make it difficult, at times, to fully understand market and counterparty risks during periods of stress. With this opacity, it can be difficult for commodity CCPs and their regulators to fully assess the size and concentration of member and client positions and to set margins accordingly. When margin calibrations do not fully represent the full spectrum of correlated risks held by a participant, a potential result is financial instability. This is because unexpected liquidity demands could lead to rapid price shifts.

Read more in our annual report