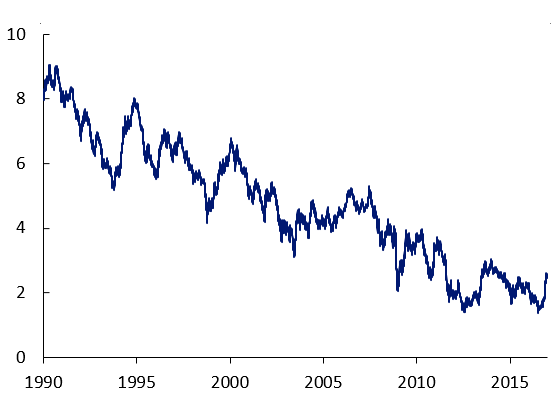

U.S. Long-Term Interest Rates Rise, But Remain Low

Published: January 13, 2017

U.S. long-term interest rates have risen from all-time lows in July, driven by stronger global economic data, higher inflation expectations, and growing expectations of a U.S. shift from monetary to fiscal policy stimulus. However, U.S. long-term rates and volatility remain low by historical standards.

Key developments in the fourth quarter of 2016

- U.S. long-term interest rates rose sharply in the past few months, especially since the U.S. election. The 10-year Treasury yield has increased more than 100 basis points since July, when it and other global long-term rates fell to all-time lows (see Figure 1). The U.S. dollar appreciated to its strongest level in more than 10 years.

- The Federal Open Market Committee (FOMC) raised short-term interest rates 25 basis points in December as expected. Committee members projected a faster pace of tightening in 2017.

- Major U.S. stock indexes set new record highs amid a general rally in U.S. risky assets. A number of metrics show U.S. stock valuations are elevated.

- China’s capital outflows accelerated, adding to an unprecedented reduction in official reserves since 2014.