Treasury Tri-party Repo Pricing

Published: September 30, 2025

Abstract

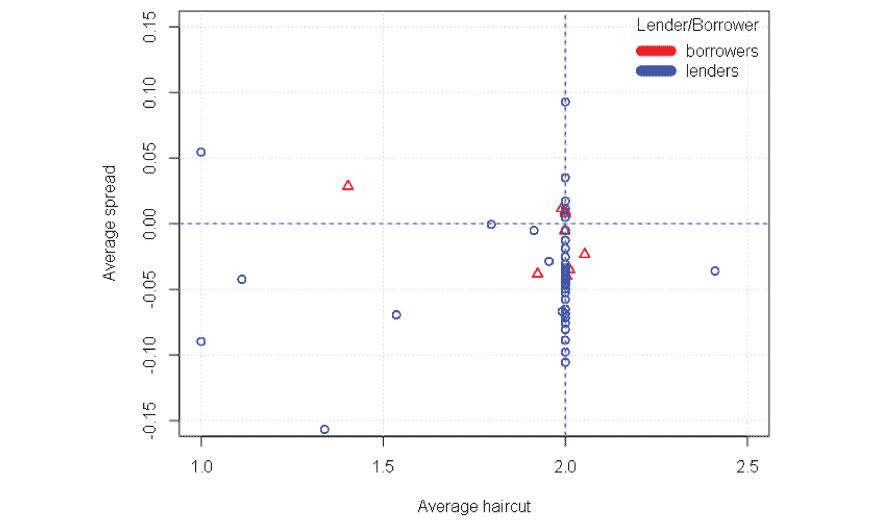

The U.S. tri-party repurchase agreement (repo) market segment is a large over-the-counter venue critical for more than $2 trillion in daily funding and central bank open market operations. Using a confidential and comprehensive dataset, this paper examines the pricing of overnight tri-party repos, a key input to the U.S. Secured Overnight Financing Rate benchmark. Despite these transactions having negligible maturity, collateral, and counterparty risk, there is significant variation in the prices that market participants receive, which depend on (1) the number of counterparties they frequently trade with, (2) the degree of diversification across those counterparties, and (3) the share of trading activity those counterparties represent. Notably, during periods of market stress, these features can significantly alter the pricing impact experienced by borrowers.

Keywords: tri-party repos, treasury repos, short-term funding, over-the-counter markets

JEL Classifications: E44, E51, G24, L14