Repo Rate Spillovers: Evidence from a Natural Experiment

Published: August 28, 2025

Abstract

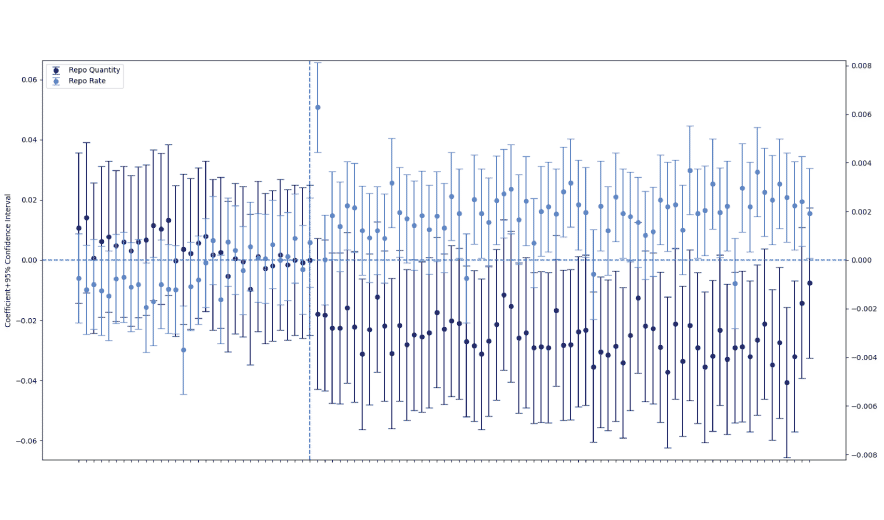

This paper explores how rises in funding costs in one asset class can spill over into other classes via the repurchase agreement market. More specifically, I inspect how a one-time policy induced exogenous increase in Treasury collateralized repo rates affected non-Treasury collateralized repo borrowing by dealers. Dealers were heterogeneously ex-posed to the rate rise due to their pre-period portfolio composition. More exposed dealers saw a 5% relative increase in the cost of borrowing in the repo market against non-Treasury collateral. This increase in funding costs came completely from an increase in repo rates, but dealers partially managed increased funding costs by lowering their total amount of repo borrowing. Rate rises are best explained by the asset class being used to collateralize the repo. However, the quantity declines are best explained by the dealer’s total increased funding costs rather than increased funding costs for individual classes, suggesting that dealers transmitted the rate change to less directly affected asset classes following the policy shock. Affected dealers decreased their non-Treasury secondary market activity immediately following the policy shock, and this resulted in declines in profitability and increased bid-ask spreads. These results show that shocks originating in one specific repo collateral class can propagate to others through the dealer’s balance sheet.