The Impact of CCP Liquidity and Capital Demands on Clearing Members Under Stress

Published: July 1, 2025

Abstract

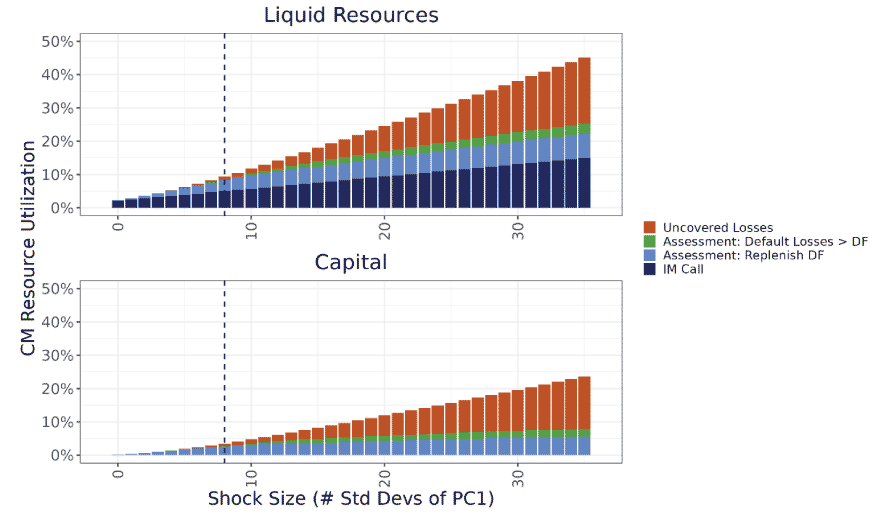

We examine the impact of liquidity and capital demands by central counterparties (CCPs) on clearing members (CMs) under stress conditions. Our methodology provides insights into potential systemic vulnerabilities and resilience in centrally cleared markets and can be used to monitor the potential impact of CCPs on their clearing members. We consider 11 major CCPs and 6 CMs that are large U.S. financial institutions. We apply various stress scenarios to both CCPs and CMs and find that, while large clearing members have sufficient resources to meet CCP demands during periods of heightened risk, the size of these demands is material and has fluctuated over time.