House Prices, Debt Burdens, and the Heterogeneous Effects of Mortgage Rate Shocks

Published: June 17, 2025

Abstract

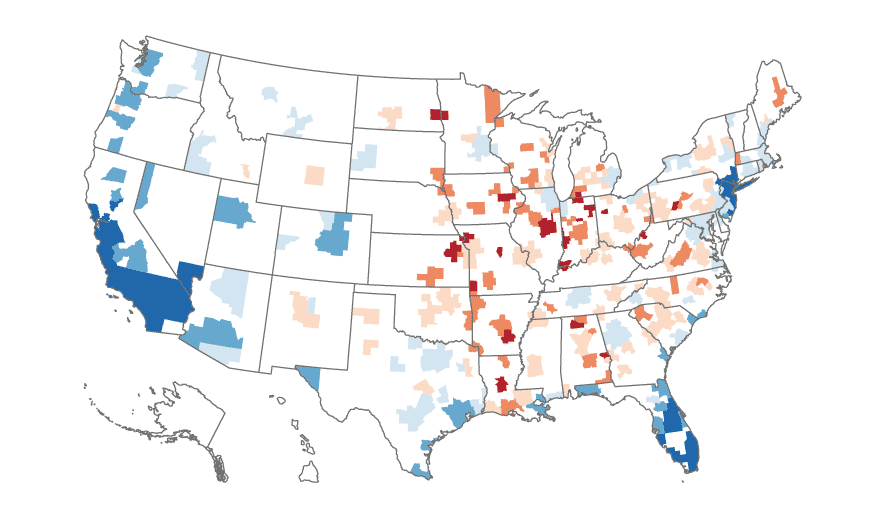

We examine the heterogeneous effects of mortgage interest rate shocks on house prices in a monthly panel of U.S. cities. Mortgage interest rate shocks, identified using Blue Chip forecast errors and monetary policy surprises, affect house prices more in cities where more borrowers have high debt burdens. This is consistent with a model with both price frictions and credit constraints. Responsiveness to interest rate shocks thus varies by location and time period, and is related to both borrower characteristics and underwriting rules. This has important implications for understanding monetary policy transmission, systemic risk, and the role of household finances in the macroeconomy.

Keywords: Asset Pricing, Household Finance, House Price Bubbles

JEL Classifications: G21, G51, E43, R30, C23