Intermediation Networks and Derivative Market Liquidity: Evidence from CDS Markets

Published: January 24, 2024

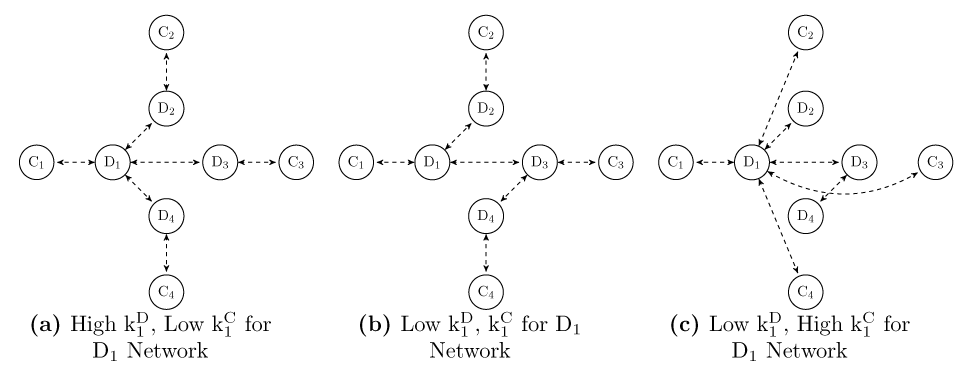

In over-the-counter markets, dealers facilitate trade by providing liquidity and acting as intermediaries. The authors present a model that links the relationships of these intermediaries to market liquidity, and they empirically test the model using supervisory data from the U.S. single-name credit default swap market (Working Paper no. 24-01).

Abstract

In over-the-counter markets, dealers facilitate trade by providing liquidity and acting as intermediaries. The authors present a model that links the relationships of these intermediaries to market liquidity, and they empirically test the model using supervisory data from the U.S. single-name credit default swap market.

Keywords: credit default swaps, dealers, intermediation costs, liquidity, OTC trading networks

JEL Classifications: D40, G12, G28, L14