Fragility of Safe Assets

Published: April 3, 2023

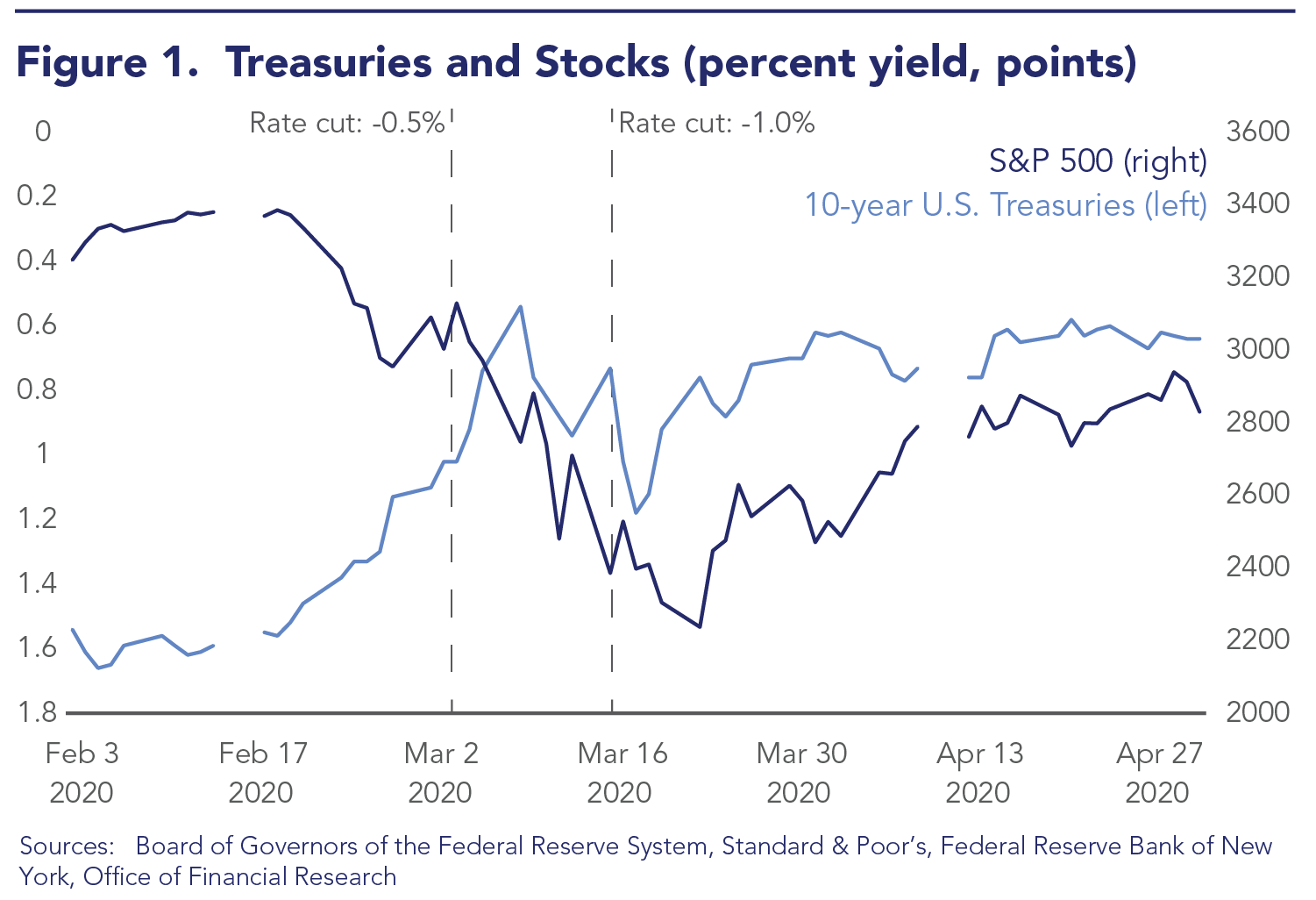

The market for U.S. Treasury securities experienced extreme stress in March 2020, when prices dropped precipitously (yields spiked) over a period of about two weeks. This was highly unusual, as Treasury prices typically increase during times of stress. Using a theoretical model, we show that markets for safe assets can be fragile due to strategic interactions among investors who hold Treasury securities for their liquidity characteristics. Worried about having to sell at potentially worse prices in the future, such investors may sell preemptively, leading to self-fulfilling “market runs” that are similar to traditional bank runs in some respects. Our results motivate potential policy interventions to stabilize the market during times of stress and disruption (Working Paper no. 23-02).

Abstract

In March 2020, safe asset markets experienced surprising and unprecedented price crashes. We explain how strategic investor behavior can create such market fragility in a model with investors valuing safety, investors valuing liquidity, and constrained dealers. While safety investors and liquidity investors can interact symbolically with offsetting trades in times of stress, liquidity investors’ strategic interaction harbors the potential for self-fulfilling fragility. When the market is fragile, standard flight-to-safety can have a destabilizing effect and trigger a “dash for cash” by liquidity investors. Well-designed policy interventions can reduce market fragility ex ante and restore orderly functioning ex post.

Keywords: safe assets, liquidity shocks, global games, treasury securities, COVID-19.

JEL Classifications: C7, G01, G1, G2, E4, E5