Digital Currency and Banking-Sector Stability

Published: March 22, 2023

Digital currencies provide a potential form of liquidity competing with bank deposits. We introduce digital currency into a macro model with a financial sector in which financial frictions generate endogenous systemic risk and instability. In the model, digital currency is fully integrated into the financial system and depresses bank deposit spreads, particularly during crises, which limits banks’ ability to recapitalize following losses (Working Paper no. 23-01).”

Abstract

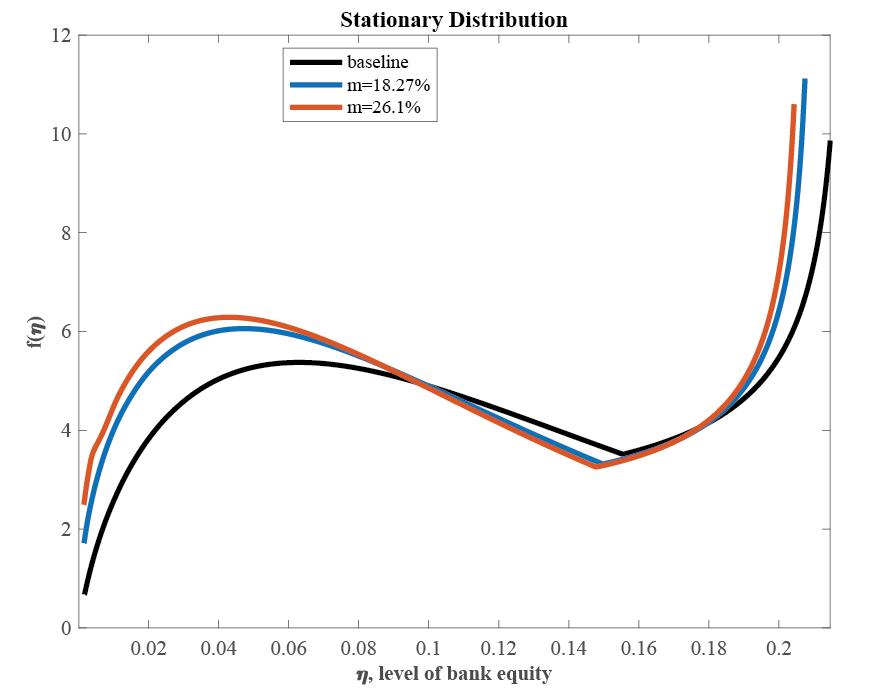

Digital currencies provide a potential form of liquidity competing with bank deposits. We introduce digital currency into a macro model with a financial sector in which financial frictions generate endogenous systemic risk and instability. In the model, digital currency is fully integrated into the financial system and depresses bank deposit spreads, particularly during crises, which limits banks’ ability to recapitalize following losses. The probability of the banking sector being in crisis states can grow significantly with the introduction of digital currency. While banking-sector stability suffers, household welfare can improve significantly. Financial frictions may limit the potential benefits of digital currencies.”

Keywords: Financial stability, Macroeconomic instability, Financial frictions, CBDC, Stablecoins.

JEL Classifications: E44, E52, E58, G01, G12, G20, G21