Counterparty Choice, Bank Interconnectedness, and Bank Risk-taking

Published: September 22, 2022

Originally Published: July 12, 2021

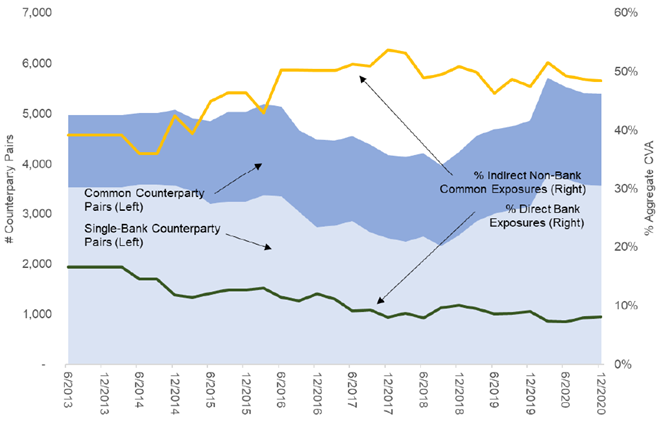

We investigate whether banks’ counterparty choices in OTC derivative markets contribute to network fragility. We use novel confidential regulatory data and show that banks are more likely to choose densely connected non-bank counterparties and do not hedge such exposures. Banks are also more likely to connect with riskier counterparties for their most material exposures, suggesting the existence of moral hazard behavior in network formation. Finally, we show that these exposures are correlated with systemic risk measures despite greater regulatory oversight after the crisis. (Working Paper no. 22-06).

Abstract

We investigate whether banks’ counterparty choices in OTC derivative markets contribute to network fragility. We use novel confidential regulatory data and show that banks are more likely to choose densely connected non-bank counterparties and do not hedge such exposures. Banks are also more likely to connect with riskier counterparties for their most material exposures, suggesting the existence of moral hazard behavior in network formation. Finally, we show that these exposures are correlated with systemic risk measures despite greater regulatory oversight after the crisis. Overall, the results provide evidence of risk propagation in bank networks through non-bank linkages in opaque markets.

Keywords: counterparty risk; financial networks; bank interconnectedness; over-the-counter markets; derivatives

JEL Classifications: G21, G22, D82