Aggregate Risk in the Term Structure of Corporate Credit

Published: April 14, 2022

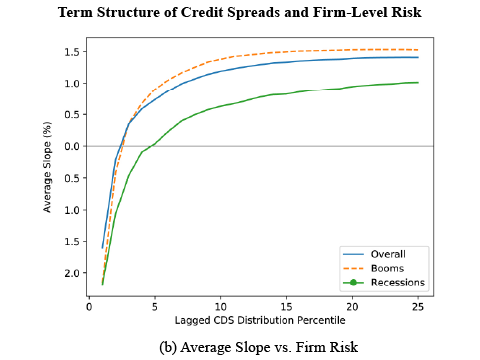

Higher rates of default can occur when corporations have difficulty accessing short- and long- term credit markets, increasing risks to financial stability. This paper uses credit spread data across different maturities to study what the shape and risk sensitivity of a firm’s term structure can tell us about its fragility. Firms that are more financially constrained display a negatively sloped credit spread curve, have short-term spreads that are more sensitive to aggregate conditions, and face heightened rollover risks. Such financing fragility at the short end of the curve can harm a firm’s ability to take advantage of investment opportunities (Working Paper no. 22-02).

Abstract

Recent global crises have brought to light the risks that corporate credit markets are exposed to, particularly in the tails of the distribution. Using firm-level, credit default swap (CDS) data across maturities, we discuss two stylized facts. First, while the term structure of credit spreads is upward sloping on average, firms that are close to default exhibit a negative slope. Second, shorter-term credit spreads display greater counter-cyclicality to aggregate risks, a fact that is driven by the behavior of financially constrained firms. To better understand these dynamics, we construct a novel, dynamic model of firm behavior where corporations issue short and long maturity debt to finance investment. The model generates an endogenous credit spread term structure that matches these facts across a distribution of firms. Moreover, we find that dis-investment by the most financially constrained firms, in order to gain additional cash in recessions, can actually amplify stress.

Keywords: Credit Spreads, CDS, Term Structure, Tail Risk, Debt Maturity.

JEL Classifications: E43, G01, G12, G32