Market-Making Costs and Liquidity: Evidence from CDS Markets

Published: March 12, 2019

This paper examines whether liquidity deteriorated in the single-name credit default swaps market due to regulatory reforms after the 2007-09 financial crisis. It finds evidence of both increased spreads and lower volumes, consistent with the reforms increasing the cost of market-making for bank-dealers. It also finds that transaction prices between dealers and clients have become more dependent on the inventories of individual dealers as interdealer trade has declined. (Working Paper no. 19-01)

Abstract

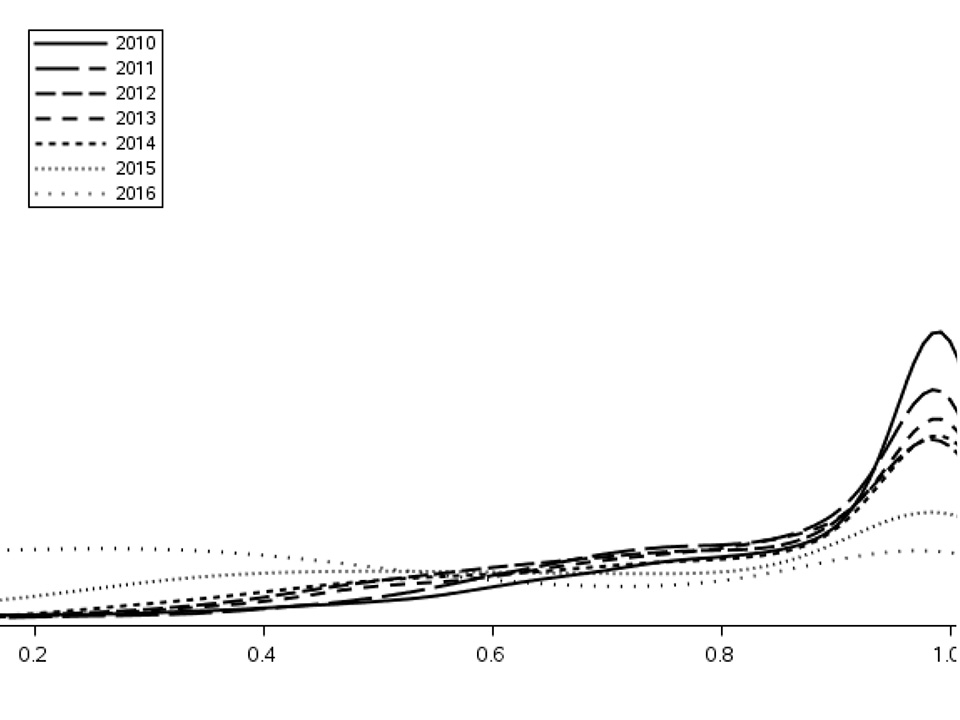

In over-the-counter markets, dealers facilitate trading by becoming market makers. The costs dealers face, including the cost of holding inventory on balance sheet, and the ease, or difficulty, of reducing their positions, determine the degree of liquidity they provide. We provide a stylized model to examine the implications of these costs on dealer behavior and market liquidity. We use the model to guide an empirical study of the single-name credit default swap (CDS) market between 2010-2016. We find that transaction prices between dealers and clients have progressively become more dependent on the inventories of individual dealers rather than on the aggregate inventory across all dealers. We also find that the volume between clients and dealers decreases across all clients, with larger declines for clients that are depository institutions. At the same time, the volume of interdealer trades decreases, dealer inventories decline, and dealers with large inventories are more likely to trade with clients. Our results are consistent with the view that regulatory reforms implemented following the 2007-09 financial crisis increased the cost of holding inventory for dealers, and the cost of interdealer trading.