Reputational Dynamics in Financial Networks During a Crisis

Published: April 19, 2018

This paper studies the role of learning and reputation in economic networks, such as interbank lending and derivatives trading networks, in times of market distress or financial crisis. The model demonstrates the importance of maintaining firm anonymity and identifies network structures that offer increased resilience. (Working Paper no. 18-03)

Abstract

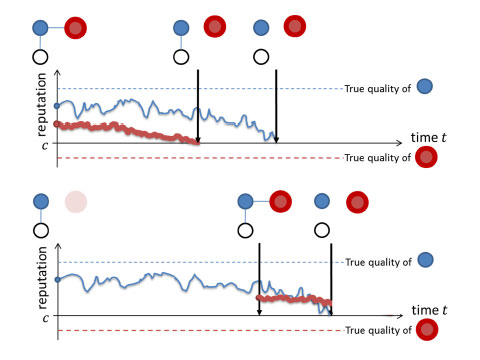

Learning and reputation play a vital role in many economic networks, such as interbank lending or derivatives trading networks, and these forces are especially impactful in times of market distress or a financial crisis. This paper is the first to study reputational learning in networks, taking into account that agents begin with incomplete information, learn about others over time, and update their connections as their beliefs evolve. In our model, agents providing high benefits develop high reputations and remain in the network, while agents providing low benefits drop in reputation and become ostracized. For example, during a crisis, banks that develop low reputations may be seen as weak and get shut out of funding. Greater information revelation increases network fragility and can negatively impact social welfare. Potential policy interventions should thus be careful to maintain firm anonymity. Certain network structures, such as coreperiphery networks, provide increased resiliency to these informational effects. Subsidizing links, such as by guaranteeing transactions in a lending network, can increase social welfare by limiting firms from being shut out.

Keywords: Network Dynamics, Network Design, Reputational Learning, Social Welfare