Investor Concentration, Flows, and Cash Holdings: Evidence from Hedge Funds

Published: December 15, 2017

Revised: June 2, 2020

Some hedge funds have a few large investors. Such a concentrated investor base can make a fund vulnerable to unexpected requests for large redemptions. This paper shows that U.S. hedge funds in part account for that risk by holding more cash and liquid assets. These holdings help funds accommodate large outflows, but also result in lower risk-adjusted returns. The Internet Appendix includes methodology details. (Working Paper no. 17-07)

Abstract

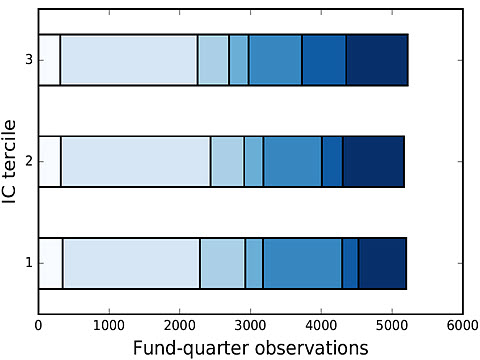

We show that when only a few investors contribute a substantial portion of a fund’s equity, the probability of large liquidity-driven fund outflows increases because investors’ idiosyncratic liquidity shocks are not diversified away. Using confidential regulatory filings, we find the five largest investors on average own 50% of a hedge fund. Consistent with our predictions, we confirm that high investor concentration hedge funds are more likely to experience large liquidity-driven outflows. Such funds hold more precautionary cash and implement other portfolio adjustments that help absorb outflows, but result in lower risk-adjusted returns. We find no evidence that hedge funds with a concentrated investor base impose longer share restrictions.

Keywords: Hedge funds, investor concentration, flows, precautionary cash

JEL Classification Numbers: G11, G20, G23