The OFR Financial Stress Index

Published: October 25, 2017

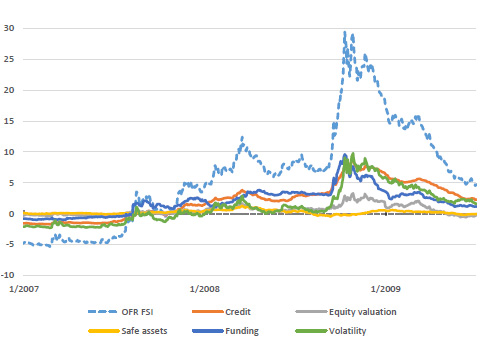

The 2007-09 financial crisis showed that stress in the financial system can have devastating effects on the economy. To measure such stress, the OFR has developed a Financial Stress Index. This working paper describes how the index is constructed and how the OFR uses it to monitor financial stability. (Working Paper no. 17-04)

Abstract

We introduce a financial stress index developed by the Office of Financial Research (OFR FSI) and detail its purpose, construction, interpretation, and use in financial market monitoring. Using a logistic regression framework and dates of government intervention in the financial system as a proxy for stress events, we find that the OFR FSI performs well in identifying systemic financial stress. In addition, we find that the OFR FSI leads the Chicago Fed National Activity Index in a Granger causality analysis, suggesting that increases in financial stress help predict decreases in economic activity.