Europe's CoCos Provide a Lesson on Uncertainty

Published: April 5, 2017

European banks issue contingent convertible bonds. These bonds can force investors to absorb losses when a bank is under stress. The authors find that heightened uncertainty about discretion by banks on when to make payments to investors and by regulators on when to trigger a loss absorption mechanism worsened price declines in a stressed market. (Working Paper no. 17-02)

Abstract

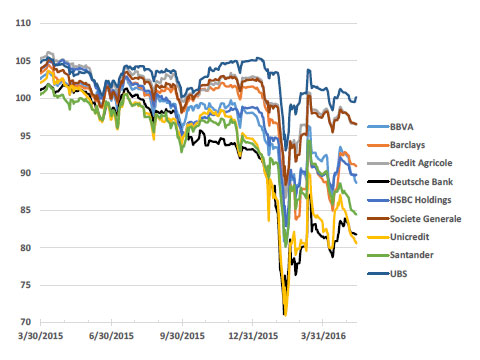

Contingent convertible bonds (CoCos) issued by European global systemically important banks (GSIBs) as part of their total loss-absorbing capacity (TLAC) are meant to enhance financial stability by forcing investors to absorb losses when a bank is under stress. Coupon payments are made at issuers’ discretion while loss absorption can be triggered at regulators’ discretion. This study investigates price effects of four press releases by Deutsche Bank AG in February 2016 related to the bank’s willingness and ability to make its upcoming CoCo coupon payments. Expected cash flow models capture changes in CoCo default risk, while event dates capture uncertainty effects. The price of a European G-SIB peer group portfolio declined a statistically significant 2.0-2.5 percent over two days in response to Deutsche Bank’s first press release. Deutsche Bank’s efforts to allay its own CoCo investors’ concerns appeared to increase concerns among CoCo investors generally. The results show potential negative effects of regulatory discretion.

Keywords: Banking, regulation, capital, modeling, risk, uncertainty

JEL classifications: G12, G14, G21, G23, G28.