Persistence and Procyclicality in Margin Requirements

Published: February 21, 2017

This paper describes how to set margin levels for derivatives contracts so that margin calls do not add to market stress during times of instability. Price volatility varies by asset class. Certain qualities of volatility should be taken into account to set the most effective margin levels without adding to market stress. (Working Paper no. 17-01)

Abstract

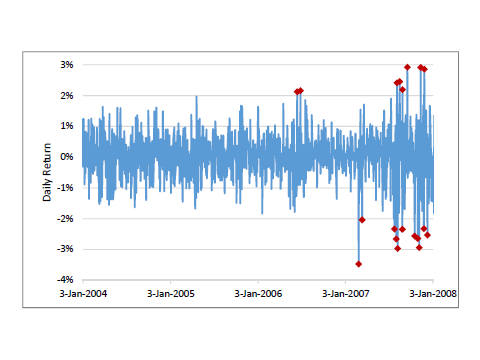

Margin requirements for derivative contracts serve as a buffer against the transmission of losses through the financial system by protecting one party to a contract against default by the other party. However, if margin levels are proportional to volatility, then a spike in volatility leads to potentially destabilizing margin calls in times of market stress. Risk-sensitive margin requirements are thus procyclical in the sense that they amplify shocks. We use a GARCH model of volatility and a combination of theoretical and empirical results to analyze how much higher margin levels need to be to avoid procyclicality while reducing counterparty credit risk. Our analysis compares the tail decay of conditional and unconditional loss distributions to compare stable and risk-sensitive margin requirements. Greater persistence and burstiness in volatility leads to a slower decay in the tail of the unconditional distribution and a higher buffer needed to avoid procyclicality. The tail decay drives other measures of procyclicality as well. Our analysis points to important features of price time series that should inform “anti-procyclicality” measures but are missing from current rules.