Do Higher Capital Standards Always Reduce Bank Risk? The Impact of the Basel Leverage Ratio on the U.S. Triparty Repo Market

Published: November 10, 2016

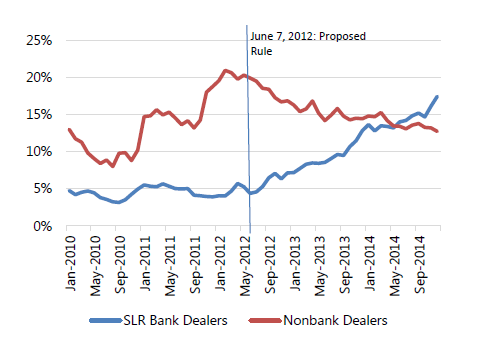

This paper examines how risk-taking in the repurchase agreement, or repo, market changed after regulators introduced the supplementary leverage ratio for banks. The paper finds that broker-dealers owned by U.S. bank holding companies now borrow less in the repo market overall after the change, but a larger percentage of the borrowing is backed by more risky collateral. (Working Paper no. 16-11)

Abstract

While simpler than risk-based capital requirements, the leverage ratio may encourage bank risktaking. This paper examines the activity of broker-dealers affiliated with bank holding companies (BHCs) and broker-dealers not affiliated with BHCs in the repurchase agreement (repo) market to test whether this may be occurring. Using data on the triparty repo market, the paper arrives at three findings. First, following the 2012 introduction of the supplementary leverage ratio (SLR), broker-dealer affiliates of BHCs decreased their repo borrowing but increased their use of repo backed by more price-volatile collateral. Second, the paper finds that regardless of whether a U.S. BHC-affiliated broker-dealer parent is above or below the SLR requirement, the announcement of the SLR rule has disincentivized those dealers affiliated with BHCs from borrowing in triparty repo. Finally, the paper finds an increase in the number of active nonbankaffiliated dealers in certain asset classes of triparty repo since the 2012 introduction of the supplementary leverage ratio. This suggests risks may be shifting outside the banking sector.

Keywords: Banking, leverage ratio, heightened prudential regulation,repurchase agreement, global systemically important banks

JEL classifications: G28, G21, G23