Interconnectedness in the Global Financial Market

Published: September 27, 2016

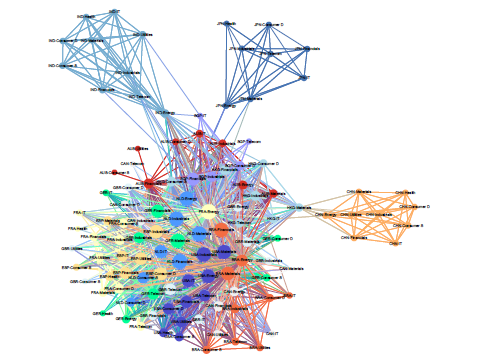

This working paper shows how network analysis can facilitate the monitoring of movements by stocks in the global financial system over time. The paper analyzes nearly 4,000 stocks in 15 countries. It concludes that stock returns tend to move together within regions — but not across them — in times of stability, but move in sync globally in times of crisis. (Working Paper no. 16-09)

Abstract

The global financial system is highly complex, with cross-border interconnections and interdependencies. In this highly interconnected environment, local financial shocks and events can be easily amplified and turned into global events. New models are needed to capture the structure of the global financial village and uncover channels of spillover and contagion. This paper analyzes the dependencies among nearly 4,000 stocks from 15 countries. The returns are normalized by the estimated volatility using a GARCH model and a robust regression process estimates pairwise statistical relationships between stocks from different markets. The estimation results are used as a measure of statistical interconnectedness, and to derive network representations, both by country and by sector. The results show that countries like the United States and Germany are in the core of the global stock market. The energy, materials, and financial sectors play an important role in connecting markets, and this role has increased over time for the energy and materials sectors. The framework provides the means to monitor interconnectedness in the global financial system on different aggregation levels, and to show how they evolve in time.

Keywords: Asset markets, Comovement, Financial networks, Interconnectedness

JEL: G15, G11, C58