A Pilot Survey of Agent Securities Lending Activity

Published: August 23, 2016

A new securities lending survey sheds light on these transactions that help underpin smooth-functioning capital markets. The pilot project by the OFR, Federal Reserve, and staff of the Securities and Exchange Commission shows that participating agents facilitated about $1 trillion in daily securities loans during a three-day period in 2015. Collecting these data on a permanent basis could help regulators identify potential vulnerabilities in a key component of our financial system. (Working Paper no. 16-08)

Abstract

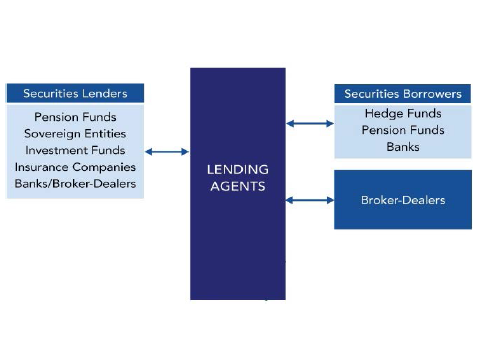

This paper reports aggregate statistics on securities lending activity based on a recently concluded pilot data collection by staff from the Office of Financial Research (OFR), the Federal Reserve System, and staff from the Securities and Exchange Commission (SEC). In its annual reports, the Financial Stability Oversight Council identified a lack of data about securities lending activity as a priority for the Council. This pilot data collection was a step toward addressing this critical data need. The voluntary pilot collection included end-of-day loan-level data for three non-consecutive business days from seven securities lending agents. Most but not all participating lending agents were subsidiaries of banks. The dataset of 75 reporting fields provides substantial new information about securities lending activity, including information concerning securities owners, securities borrowers, attributes of securities loans, collateral management, and cash reinvestment practices. However, the pilot data collection was limited in scope and duration. Comprehensive data are still lacking. To close this data gap, a permanent collection of data covering securities lending activity is recommended by the Council.