A Map of Collateral Uses and Flows

Published: May 26, 2016

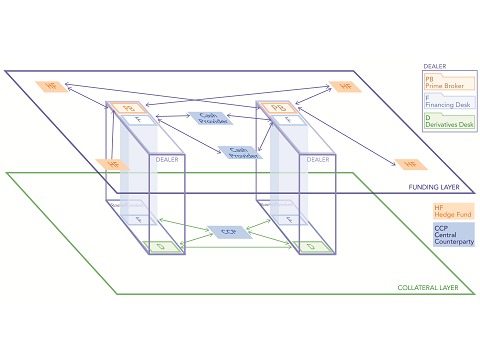

Collateral is exchanged among market participants to support financial activities, including secured funding, securities lending, securities exchanges, margin lending, derivatives, and clearing. This working paper creates a collateral map to show how collateral moves among bilateral counterparties, triparty banks, and central counterparties, and can spread stress through the financial system. The paper also discusses the recent increase in collateral demand, effects of post-crisis regulation, and collateral-related stress scenarios. (Working Paper no. 16-06)

Abstract

All flows of secured funding in the financial system are met by flows of collateral in the opposite direction. A network depicting secured funding flows thus implicitly reveals a network of collateral flows. Collateral can also be presented as its own network to show collateral arrangements with bilateral counterparties, triparty banks, and central counterparties; the purpose and incentives of collateral exchanges; and participants involved. We create a collateral map to show how this function of the financial system works, especially with secured funding and derivatives activity. This paper provides insights into the increased demand for collateral, the reduced capacity for banks to act as collateral intermediaries, and examples of risks and vulnerabilities in collateral flows.

Keywords: Collateral, funding liquidity, central clearing, repo, derivatives, funding map, financial stability.