The Real Consequences of Bank Mortgage Lending Standards

Published: May 11, 2016

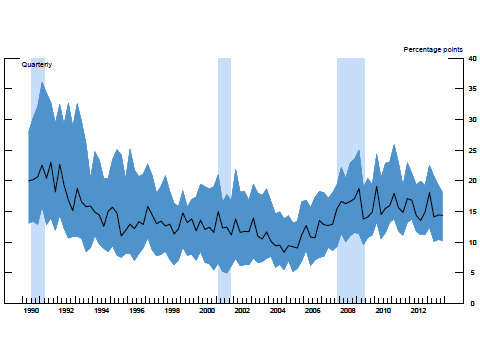

This paper describes how mortgage lending standards, as measured by responses to the Federal Reserve’s quarterly Senior Loan Officer Opinion Survey, relate to changes in the availability of mortgage loans at banks from 1990 to 2013. The research suggests that the survey’s reported changes in credit standards are a leading indicator of the financial industry’s vulnerability to shocks. (Working Paper no. 16-05)

Abstract

Bank loan underwriting standards are key determinants of credit availability. To better understand what happens when bank loan officers change standards, we match responses from the Federal Reserve’s Senior Loan Officer Opinion Survey (SLOOS) with mortgage application information from the Home Mortgage Disclosure Act (HMDA)over the period from 1990 to 2013. HMDA data contain both accepted and denied applications, allowing us to observe changes in denial rates when loan officers report changing standards. Reports of tightened standards are associated with an increase of about 1 percentage point in denial rates (conditioning on changes in macroeconomic conditions and borrower credit quality), implying a reduction in aggregate mortgage credit of about $690 million per quarter. Reports of easing standards, though less frequent over that period, are associated with a 1 percentage point decline in denial rates. Denial rate changes are larger for banks that hold most of their mortgages on portfolio (rather than securitizing them). Tighter standards are associated with about 16 percent fewer high interest rate loans (a proxy for riskier loans). Applications rise at banks that report strengthening demand for mortgage loans. Metropolitan statistical areas (MSAs) that have more exposure to SLOOS banks that have tightened standards have much lower delinquency rates two years following the tightening — suggesting that standards are an important determinant of the credit quality of bank loan portfolios. House prices also fall in MSAs that have exposure to SLOOS banks that report tightening