Stressed to the Core: Counterparty Concentrations and Systemic Losses in CDS Markets

Published: March 8, 2016

This paper applies the Federal Reserve’s supervisory stress test scenarios to examine the impacts on banks — and the banking system as a whole — from default of their largest counterparties in the credit derivatives markets. The authors find higher loss concentrations for the banking system than for individual firms and potential for large indirect losses when a major counterparty defaults. (Working Paper no. 16-01)

Abstract

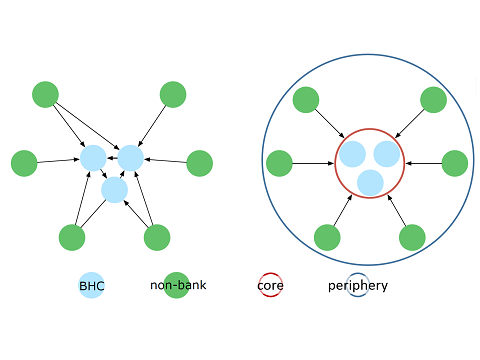

Supervisory stress testing to date has focused on the resiliency of large banks to withstand the direct effects of a credit shock. Using data from Depository Trust & Clearing Corporation (DTCC), we apply the Federal Reserve’s Comprehensive Capital Analysis and Review (CCAR) supervisory scenarios to evaluate the default of a bank’s largest counterparty. We find that indirect effects of this default, through the bank’s other counterparties, are larger than the direct impact on the bank. Further, when taken as a whole, the core banking system has a higher concentration to a single counterparty than does any individual bank holding company. Under the 2015 stress, the banking system’s counterparty credit concentration is high and corresponds in diversity to a market with just over three firms. Our results are the first to evaluate the credit derivatives market under stress and also underscore the importance of a macroprudential perspective on stress testing.

Keywords: Credit default swaps, stress testing, systemic risk, financial networks, counterparty exposure, contagion

JEL Classification Numbers: D85, G01, G13, G20, L14