The Difficult Business of Measuring Banks' Liquidity: Understanding the Liquidity Coverage Ratio

Published: October 7, 2015

Bank regulators adopted a new requirement called the Liquidity Coverage Ratio after the financial crisis to help ensure banks maintain enough liquid assets to cover their financial obligations during times of stress. This paper uses a series of increasingly complex examples to demonstrate issues in analyzing this new liquidity metric. (Working Paper no. 15-20)

Abstract

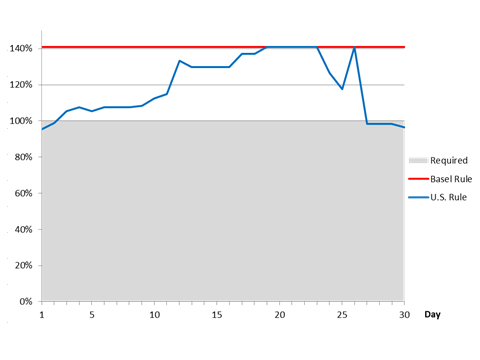

In the wake of the financial crisis of 2007-09, the Basel Committee on Banking Supervision recommended bank regulators adopt a new short-term liquidity requirement, the liquidity coverage ratio (LCR), to promote greater liquidity resilience. U.S. bank regulators announced the final rule implementing that recommendation in 2014. We highlight complexities in interpreting LCRs under both Basel III and the U.S. rule when banks undertake transactions that simultaneously affect the LCR numerator and denominator, and therefore, the ratio itself. Furthermore, we show how the numerator and denominator caps in the LCR formulas introduce nonlinearities that add to the complexity of interpreting changes in the metric. LCRs calculated under the U.S. rule are more volatile and difficult to interpret than LCRs calculated under the Basel standard. This is because the U.S. rule adds a time dimension to the LCR’s volatility through inclusion of a maturity mismatch add-on term in the denominator to account for the peak-day net cash outflow during the 30-day window. Unlike some other regulatory ratios, bank supervisors, analysts, and investors need to have a clear understanding of the mechanics of LCR calculations to interpret the LCR metric, separate signal from noise, and perform informed peer analysis. In this paper, we demonstrate how the LCR is calculated under both Basel and U.S. rules to help market participants, the public, and researchers better understand this new liquidity metric.

Keywords: Banking, funding

JEL classifications: G14, G18, G21, G28.