An Agent-based Model for Crisis Liquidity Dynamics

Published: September 16, 2015

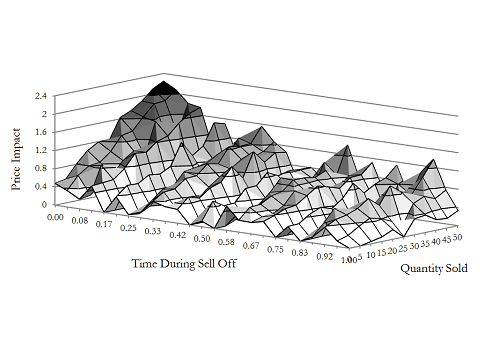

This paper presents an agent-based model for examining price impacts and liquidity dynamics during financial crises, which are often characterized by sharp reductions in liquidity followed by cascades of falling prices. The model highlights the implications of changes in market makers’ ability to provide intermediation services and the decision cycles of liquidity demanders versus liquidity suppliers during a crisis. (Working Paper no. 15-18)

Abstract

Financial crises are often characterized by sharp reductions in liquidity followed by cascades of falling prices. Researchers are making progress in work to understand the levels of liquidity on a daily basis, but understanding the vulnerability of liquidity to market shocks remains a challenge. We develop an agent-based model with the objective of evaluating the market dynamics that lead the market supply of liquidity to recede during periods of crisis. The model uses a limit-order-book framework to examine the interaction of three types of traditional market agents: liquidity demanders, liquidity suppliers, and market makers. The paper highlights the implications of changes in market makers’ ability to provide intermediation services and the heterogeneous decision cycles of liquidity demanders versus liquidity suppliers for crisis-induced illiquidity.

Keywords: Liquidity, agent-based modeling, price impact, limit orderbook, market making JEL Classification Numbers: D40, G01, G12, G14, G17, G33

Attachments:

- Source Code: Liquidity Model