Reference Guide to U.S. Repo and Securities Lending Markets

Published: September 9, 2015

This paper is a reference guide on U.S. repo and securities lending markets. It discusses the main institutional features of these markets, their vulnerabilities, and data gaps that prevent market participants and regulators from addressing known vulnerabilities. (Working Paper no. 15-17)

Abstract

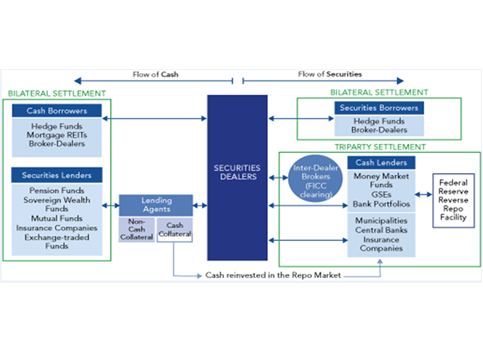

This paper is intended to serve as a reference guide on U.S. repo and securities lending markets. It begins by presenting the institutional structure, describing the market landscape, the role of the participants, and other characteristics, including how repo and securities lending activity has changed since the 2007-09 financial crisis. The paper then discusses vulnerabilities in the repo and short-term wholesale funding markets and efforts to limit potential systemic risks. It next provides an overview of existing data sources on securities financing markets, and highlights specific shortcomings related to data standards and data quality. Lastly, the authors discuss a near-term agenda to help fill some of the data gaps in repo and securities lending markets.