Economic Uncertainty and Commodity Futures Volatility

Published: August 6, 2015

This paper investigates the dynamics of commodity futures volatility and analyzes the impact of increased emerging market demand on commodity markets. (Working Paper no. 15-14)

Abstract

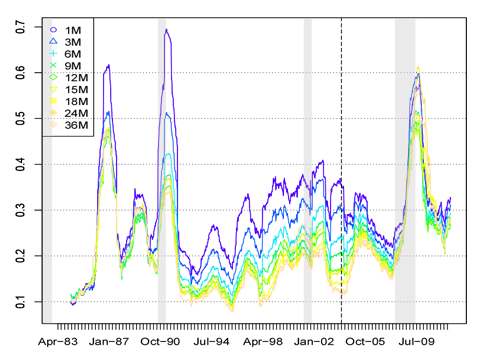

This paper investigates the dynamics of commodity futures volatility. I derive the variance decomposition for the futures basis to show how unexpected excess returns result from new information about expected future interest rates, convenience yields, and risk premia. This motivates my empirical analysis of the volatility impact of economic and inflation regimes and commodity supply-demand shocks. Using data on major commodity futures markets and global bilateral commodity trade, I analyze the extent to which commodity volatility is related to fundamental uncertainty arising from increased emerging market demand and macroeconomic uncertainty, and control for the potential impact of financial frictions introduced by changing market structure and index trading. I find that a higher concentration in the emerging market importers of a commodity is associated with higher futures volatility. Commodity futures volatility is significantly predictable using variables capturing macroeconomic uncertainty. I examine the conditional variation in the asymmetric relationship between returns and volatility, and how this relates to the futures basis and sensitivity to consumer and producer shocks.