Dynamical Macroprudential Stress Testing Using Network Theory

Published: June 18, 2015

This paper presents a dynamic bipartite network model for a stress test of a banking system’s sensitivity to external shocks in individual asset classes. As a case study, the model is applied to investigate the Venezuelan banking system from 1998 to 2013. The model quantifies the sensitivity of bank portfolios to different shock scenarios and identifies systemic vulnerabilities that stem from connectivity and network effects, and their time evolution. The model provides a framework for dynamical macroprudential stress testing. (Working Paper no. 15-12)

Abstract

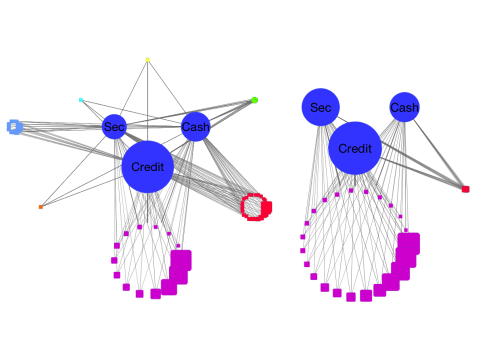

The increasing frequency and scope of financial crises have made global fi- nancial stability one of the major concerns of economic policy and decision makers. This has led to the understanding that financial and banking supervision has to be thought of as a systemic task, focusing on the interdependent relations among the institutions. Using network theory, we develop a dynamic model that uses a bipartite network of banks and their assets to analyze the system’s sensitivity to external shocks in individual asset classes and to evaluate the presence of features underlying the system that could lead to contagion. As a case study, we apply the model to stress test the Venezuelan banking system from 1998 to 2013. The introduced model was able to capture monthly changes in the structure of the system and the sensitivity of bank portfolios to different external shock scenarios and to identify systemic vulnerabilities and their time evolution. The model provides new tools for policy makers and supervision agencies to use for macroprudential dynamical stress testing.

Keywords: Financial Networks, Interdependence, Contagion, Banking System, Venezuela, macroprudential

JEL: G21, D85, N26, G18