Systemwide Commonalities in Market Liquidity

Published: May 28, 2015

Revised: December 14, 2016

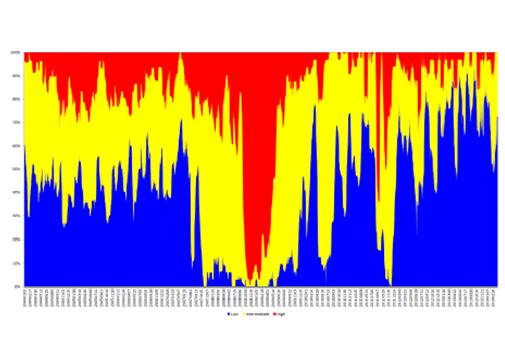

This paper identifies hidden liquidity regimes (high, medium and low) across a broad range of financial markets that can be used for characterizing periods of market stress and identifying underlying predictors of liquidity shocks. This regime could have provided meaningful predictions of liquidity disruptions up to 15 trading days in advance of the 2008 financial crisis. These methods offer a potential framework for monitoring and predicting a systemwide collapse in market liquidity, which could signal a collapse of liquidity in the funding markets as experienced in the financial crisis. (Working Paper no. 15-11)

Abstract

We explore statistical commonalities among granular measures of market liquidity with the goal of illuminating systemwide patterns in aggregate liquidity. We calculate daily invariant price impacts described by Kyle and Obizhaeva [2016] to assemble a granular panel of liquidity measures for equity, corporate bond, and futures markets. We estimate Bayesian models of hidden Markov chains and use Markov chain Monte Carlo analysis to measure the latent structure governing liquidity at the systemwide level. Three latent liquidity regimes — high, medium, and low price-impact — are adequate to describe each of the markets. Focusing on the equities subpanel, we test whether a collection of systemwide market summaries can recover the estimated liquidity dynamics. This version of the model allows an economically meaningful attribution of the latent liquidity states and yields meaningful predictions of liquidity disruptions as far as 15 trading days in advance of the 2008 financial crisis.