Common Ground: The Need for a Universal Mortgage Loan Identifier

Published: December 5, 2013

The U.S. mortgage finance system is a critical part of our nation’s financial system, representing 70 percent of U.S. household liabilities. The establishment of a single, cradle‐to‐grave, universal mortgage identifier that cannot be linked to individuals using publicly‐available data would significantly benefit regulators and researchers. (Working Paper no. 13-12)

Abstract

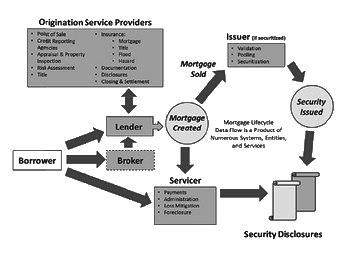

The U.S. mortgage finance system is a critical part of our nation’s financial system, representing 70 percent of U.S. household liabilities. It is also highly complex, with many finance channels, participants, and regulators. The data produced by this system reflect that complexity; unfortunately, no single identifier exists to link the major loan‐level mortgage datasets. The establishment of a single, cradle‐to‐grave, universal mortgage identifier that cannot be linked to individuals using publicly‐available data would significantly benefit regulators and researchers by enabling better integration of the fragmented data produced by the U.S. mortgage finance system. Such an identifier could additionally serve as the foundation of a system that could benefit private market participants, as long as such a system protected individual privacy.