Cryptography and the Economics of Supervisory Information: Balancing Transparency and Confidentiality

Published: September 4, 2013

This paper explores tradeoffs between transparency and confidentiality in financial regulation and discusses new techniques from the fields of secure computation and statistical data privacy that can facilitate the secure sharing of financial information. (Working Paper no. 13-11)

Abstract

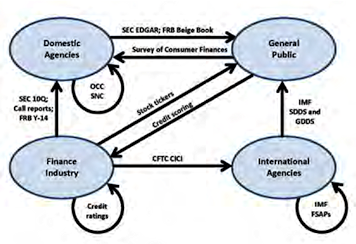

We elucidate the tradeoffs between transparency and confidentiality in the context of financial regulation. The structure of information in financial contexts creates incentives with a pervasive effect on financial institutions and their relationships. This includes supervisory institutions, which must balance the opposing forces of confidentiality and transparency that arise from their examination and disclosure duties. Prudential supervision can expose confidential information to examiners who have a duty to protect it. Disclosure policies work to reduce information asymmetries, empowering investors and fostering market discipline. The resulting confidentiality/transparency dichotomy tends to push supervisory information policies to one extreme or the other. We argue that there are important intermediate cases in which limited information sharing would be welfare-improving, and that this can be achieved with careful use of new techniques from the fields of secure computation and statistical data privacy. We provide a broad overview of these new technologies. We also describe three specific usage scenarios where such beneficial solutions might be implemented.