How Likely is Contagion in Financial Networks?

Published: June 21, 2013

Revised: April 12, 2017

This paper estimates how much interconnections among financial institutions - potential channels for contagion and amplification of shocks to the financial system - can increase expected losses from a wide range of shocks. (Working Paper no. 13-09)

Abstract

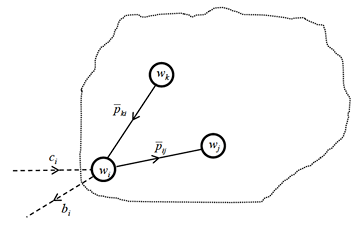

Interconnections among financial institutions create potential channels for contagion and amplification of shocks to the financial system. We estimate the extent to which interconnections increase expected losses and defaults under a wide range of shock distributions. In contrast to most work on financial networks, we assume only minimal information about network structure and rely instead on information about the individual institutions that are the nodes of the network. The key node-level quantities are asset size, leverage, and a financial connectivity measure given by the fraction of a financial institution’s liabilities held by other financial institutions. We combine these measures to derive explicit bounds on the potential magnitude of network effects on contagion and loss amplification. Spillover effects are most significant when node sizes are heterogeneous and the originating node is highly leveraged and has high financial connectivity. Our results also highlight the importance of mechanisms that go beyond simple spillover effects to magnify shocks; these include bankruptcy costs, and mark-to-market losses resulting from credit quality deterioration or a loss of confidence. We illustrate the results with data on the European banking system.

Keywords: systemic risk, contagion, financial network

JEL: D85, G21