Hedge Fund Contagion and Risk-adjusted Returns: A Markov-switching Dynamic Factor Approach

Published: March 13, 2013

This paper uses a flexible framework to analyze two important phenomena influencing the hedge fund industry - contagion and time variation in risk-adjusted return. (Working Paper no. 13-06)

Abstract

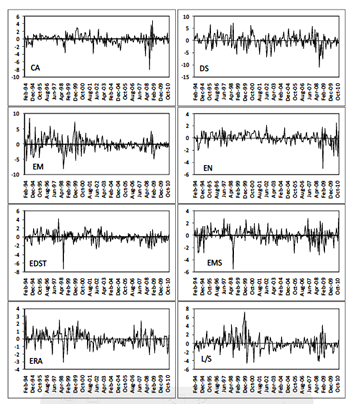

We provide an empirical analysis of two important phenomena influencing the hedge fund industry — contagion and time variation in risk-adjusted return (alpha) — in a flexible unified framework. After accounting for standard hedge fund pricing factors, we quantify the common latent factor in hedge fund style index returns and model its time-varying behavior using a dynamic factor framework featuring Markov regime-switching. We find that three regimes - crash, low mean, and high mean - are necessary to provide a complete description of joint hedge fund return dynamics. We also document significant time variation in the alpha-generating ability of all hedge fund investment styles. The period following the stock market crash of 2000 is dominated by the persistent low-return state, while the long bull market of the 1990s is associated with the strongest performance of the industry generating high positive returns. We also investigate drivers of the regime shifts in the common latent pricing factor and find that both flight to safety and large funding liquidity shocks play important roles in explaining the abrupt shift of the common factor to the crash state.

Keywords: Hedge fund, Contagion, Risk-adjusted return, Dynamic factor models, Markov-switching, Funding liquidity, Flight to safety

JEL codes: G01, C32, C58